A lock-up period in an IPO refers to a predetermined timeframe during which company insiders, such as executives and early investors, are restricted from selling their shares. This period typically ranges from 90 to 180 days following the IPO date, helping to stabilize stock prices by preventing a sudden influx of shares in the market. For instance, Facebook's IPO in 2012 had a 180-day lock-up period, during which major shareholders were unable to sell their shares. Lock-up periods are crucial for maintaining investor confidence and ensuring orderly market behavior post-IPO. During this time, restricted shareholders hold onto their equity, which supports share price stability and can influence market perceptions. The expiration of the lock-up period often leads to increased trading volume and potential price volatility, as insiders begin to sell their shares on the open market.

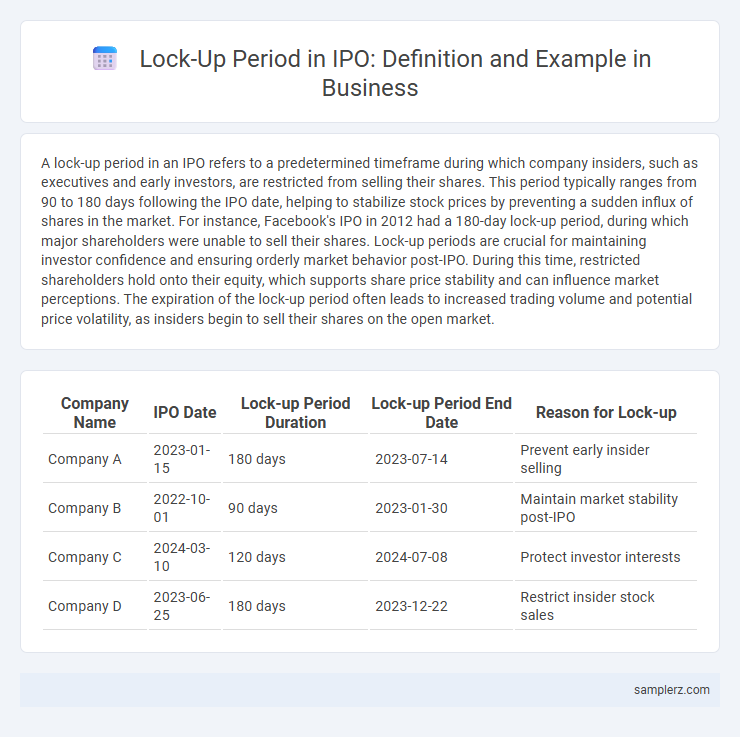

Table of Comparison

| Company Name | IPO Date | Lock-up Period Duration | Lock-up Period End Date | Reason for Lock-up |

|---|---|---|---|---|

| Company A | 2023-01-15 | 180 days | 2023-07-14 | Prevent early insider selling |

| Company B | 2022-10-01 | 90 days | 2023-01-30 | Maintain market stability post-IPO |

| Company C | 2024-03-10 | 120 days | 2024-07-08 | Protect investor interests |

| Company D | 2023-06-25 | 180 days | 2023-12-22 | Restrict insider stock sales |

Understanding the Lock-Up Period in IPOs

A lock-up period in an IPO typically ranges from 90 to 180 days, during which insiders such as company executives and early investors are restricted from selling their shares to prevent market flooding. This restriction helps maintain stock price stability after the initial offering by limiting the supply of shares available for trading. Understanding the lock-up period is crucial for investors as it can significantly impact stock price volatility once the lock-up expires and insiders gain the ability to sell their holdings.

Key Features of IPO Lock-Up Agreements

IPO lock-up agreements typically restrict insiders, including company executives and early investors, from selling shares for 90 to 180 days post-IPO to stabilize the stock price. These agreements aim to prevent sudden stock price volatility by controlling the supply of shares on the market during the initial trading period. Violations of lock-up periods can lead to legal penalties and negatively impact investor confidence in the company.

Real-Life Examples of IPO Lock-Up Periods

In the 2012 Facebook IPO, the lock-up period lasted 180 days, preventing insiders from selling shares immediately after the public offering, which helped stabilize stock prices post-listing. Snapchat's 2017 IPO imposed a 180-day lock-up period on founders and early investors, allowing market performance to settle before large-scale share liquidation. Airbnb's 2020 IPO featured a 90-day lock-up period, balancing investor confidence and liquidity needs amidst volatile market conditions.

Impact of Lock-Up Expiry on Share Prices

Lock-up periods in IPOs, typically lasting 90 to 180 days, prevent insiders from selling shares immediately after the listing, stabilizing early trading prices. When the lock-up expires, a surge of shares may flood the market, often causing a temporary decline in share prices due to increased supply. This impact varies by company size and investor sentiment but remains critical for market volatility and post-IPO price performance.

Notable Companies and Their Lock-Up Periods

Notable companies such as Facebook imposed a 180-day lock-up period during their IPO, preventing insiders from selling shares immediately and stabilizing stock prices. Google set a 180-day lock-up period as well, ensuring a controlled share release to maintain market confidence. Uber extended its lock-up period to 180 days, reflecting a common industry standard for mitigating volatility after public offerings.

Common Lock-Up Period Durations in Different Industries

The common lock-up period in IPOs varies by industry, typically lasting 90 to 180 days for technology companies, allowing early investors to retain shares without immediate selling pressure. Healthcare and biotechnology firms often experience longer lock-up periods, sometimes extending to 180 days or more, due to regulatory scrutiny and clinical trial timelines. Financial and consumer goods sectors usually have shorter lock-up periods around 90 days, reflecting faster market absorption and investor liquidity preferences.

Strategic Reasons for Implementing Lock-Up Periods

Lock-up periods in IPOs often last between 90 to 180 days, restricting insiders from selling shares immediately after the public offering. These periods stabilize stock prices by preventing a sudden surge in share supply, which helps maintain investor confidence and supports long-term company valuation. Strategic reasons for implementing lock-up periods include aligning insider interests with market performance, ensuring orderly market behavior, and fostering a stable post-IPO trading environment.

Investor Perspective on IPO Lock-Up Periods

Investors in IPO lock-up periods typically face restrictions on selling shares for 90 to 180 days, which can limit liquidity and potential profit-taking immediately after listing. This lock-up timeframe helps stabilize the stock price by preventing large sell-offs but demands patience from investors seeking short-term gains. Understanding the lock-up schedule is crucial for managing expectations and strategizing post-IPO investment exits effectively.

Regulatory Guidelines for IPO Lock-Up Agreements

IPO lock-up agreements typically restrict insiders from selling shares for 90 to 180 days post-offering, as mandated by regulatory guidelines such as the SEC Rule 144. These lock-up periods aim to prevent market instability by controlling share supply immediately after an initial public offering. Ensuring compliance with these regulatory frameworks is critical for underwriters and issuers to maintain investor confidence and uphold fair market practices.

How to Manage Risks During Lock-Up Period Expiry

Lock-up periods in IPOs typically last 90 to 180 days, during which insiders are restricted from selling their shares to stabilize stock prices post-listing. Managing risks as the lock-up expiry approaches involves closely monitoring insider share release schedules, stock price fluctuations, and market sentiment to anticipate potential volatility. Employing hedging strategies, maintaining liquidity reserves, and diversifying portfolios can help investors and companies mitigate adverse impacts during this critical phase.

example of lock-up period in IPO Infographic

samplerz.com

samplerz.com