Sweat equity in business refers to the non-monetary investment that individuals contribute through labor, effort, and time instead of cash. For example, a startup founder might work for months developing a product, marketing, and managing operations without taking a salary. This work builds value in the company, which can later be quantified as ownership shares. In a small business, sweat equity often represents the value created by owners or partners who actively participate in daily tasks. For instance, a co-founder who handles technical development and customer acquisition might receive a larger equity stake despite limited initial capital investment. Investors and stakeholders recognize this contribution as a critical asset that drives business growth and profitability.

Table of Comparison

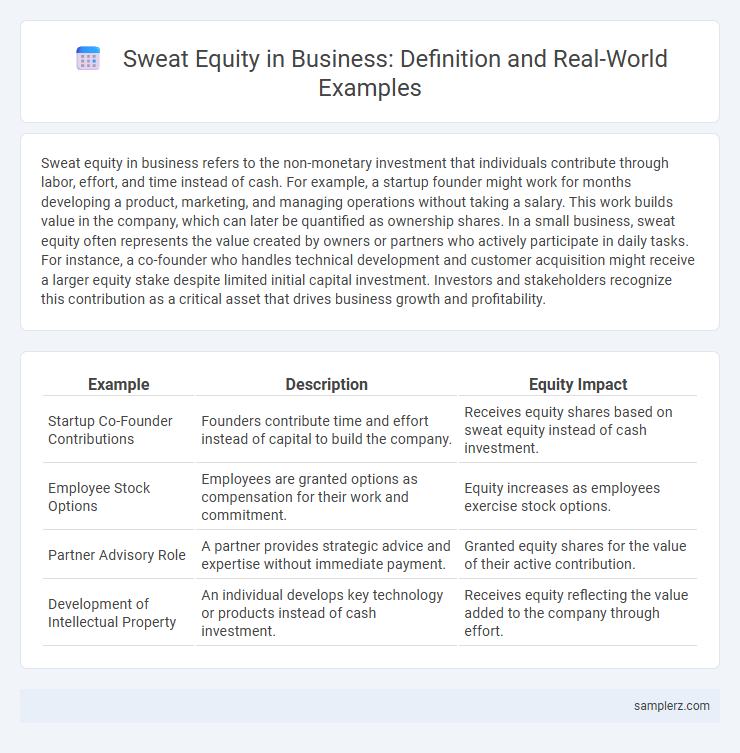

| Example | Description | Equity Impact |

|---|---|---|

| Startup Co-Founder Contributions | Founders contribute time and effort instead of capital to build the company. | Receives equity shares based on sweat equity instead of cash investment. |

| Employee Stock Options | Employees are granted options as compensation for their work and commitment. | Equity increases as employees exercise stock options. |

| Partner Advisory Role | A partner provides strategic advice and expertise without immediate payment. | Granted equity shares for the value of their active contribution. |

| Development of Intellectual Property | An individual develops key technology or products instead of cash investment. | Receives equity reflecting the value added to the company through effort. |

Understanding Sweat Equity in Business

Sweat equity in business refers to the non-monetary investment made by founders or employees through time, effort, and expertise to build and grow a company. This type of equity is often granted as ownership shares in lieu of salary or direct financial investment, aligning stakeholders' incentives with the company's success. Recognizing sweat equity is crucial in startups where cash flow is limited, but founders contribute significant value through their skills and dedication.

Key Examples of Sweat Equity Contributions

Key examples of sweat equity contributions include founders dedicating extensive hours to product development, early employees investing time in building the company's infrastructure, and partners providing strategic expertise without immediate financial compensation. These non-monetary inputs significantly increase the business's value by reducing initial costs and accelerating growth. Documenting these contributions clearly is essential for equitable ownership distribution and future investment negotiations.

Sweat Equity in Startup Companies

Sweat equity in startup companies represents the non-monetary investment founders contribute through their time, effort, and expertise to build and grow the business. This form of equity is commonly used to compensate early team members when financial resources are limited, aligning their incentives with the company's long-term success. Valuing sweat equity involves assessing the founders' roles, market salary equivalents, and the startup's overall valuation to ensure fair ownership distribution.

Sweat Equity for Founders and Co-Founders

Sweat equity for founders and co-founders represents the non-monetary investment of time, effort, and expertise contributed to build and grow a startup, often exchanged for ownership stakes. This form of equity is critical in early-stage ventures where cash flow is limited, allowing founders to retain control while rewarding their commitment. Valuing sweat equity accurately depends on factors such as the startup's valuation, individual roles, and the expected time horizon for growth and exit.

Employee Compensation through Sweat Equity

Employee compensation through sweat equity involves granting employees ownership stakes in a company as a form of non-monetary remuneration, aligning their interests with business growth. This method incentivizes long-term commitment and productivity by converting labor contributions into equity shares, often seen in startups and early-stage companies. Sweat equity can enhance employee motivation and retention while providing financial rewards tied directly to the company's success.

Case Study: Sweat Equity in Family Businesses

Sweat equity in family businesses often manifests through unpaid labor contributed by family members during early stages, significantly increasing the company's valuation without immediate financial investment. A notable case study is the Murugappa Group, where founding family members invested extensive time and expertise, propelling the business's growth and equity value. This form of sweat equity enhances ownership stakes and fosters long-term commitment within family-run enterprises.

Sweat Equity vs. Financial Investment

Sweat equity represents the non-monetary value a founder or employee contributes through effort, skills, and time, enhancing a company's worth without direct financial input. Unlike financial investment, which involves injecting capital to acquire ownership, sweat equity builds value through labor and expertise, often rewarded with share ownership or profit participation. This form of investment aligns personal commitment with business growth, particularly in startups lacking immediate funding resources.

Legal Considerations in Sweat Equity Arrangements

Sweat equity arrangements require clear legal documentation to define roles, responsibilities, and equity stakes in a business partnership. Intellectual property rights generated through contributed work must be explicitly assigned to avoid future disputes. Compliance with securities regulations ensures that the issuance of sweat equity shares meets legal standards and protects all parties involved.

Measuring the Value of Sweat Equity

Measuring the value of sweat equity involves quantifying the non-monetary contributions made by founders or employees through time, effort, and expertise invested in a business. Common methods include calculating the fair market value of equivalent services, using discounted cash flow models to estimate future benefits generated by the work, or setting a fixed equity percentage based on agreed-upon milestones. Accurate valuation requires clear documentation, valuation benchmarks, and alignment with investor expectations to ensure equitable ownership distribution.

Real-Life Success Stories of Sweat Equity

Real-life success stories of sweat equity include Airbnb founders Brian Chesky and Joe Gebbia, who transformed a small apartment and personal effort into a multi-billion-dollar company without significant initial capital. Another example is Ben Francis, who built Gymshark from a garage by investing time and skills instead of startup funds, leading to a globally recognized fitness brand. These entrepreneurs leveraged sweat equity to create substantial business value, demonstrating commitment and innovation as critical factors in startup success.

example of sweat in equity Infographic

samplerz.com

samplerz.com