The BCG matrix is a strategic tool used in business to analyze a company's product portfolio based on market growth rate and relative market share. It categorizes products into four quadrants: Stars, Cash Cows, Question Marks, and Dogs. For example, a technology company might classify its flagship smartphone as a Star due to high market growth and strong market share, while an older model phone might be considered a Dog with low growth and low market share. In practical data analysis, the BCG matrix helps managers allocate resources effectively by identifying products that require investment, maintenance, or divestment. For instance, a retail chain could analyze sales data and market trends to identify Cash Cows like popular household items generating steady cash flow despite low market growth. Question Marks in this scenario might be new product lines with potential but uncertain market share, indicating a need for strategic decisions based on data-driven insights.

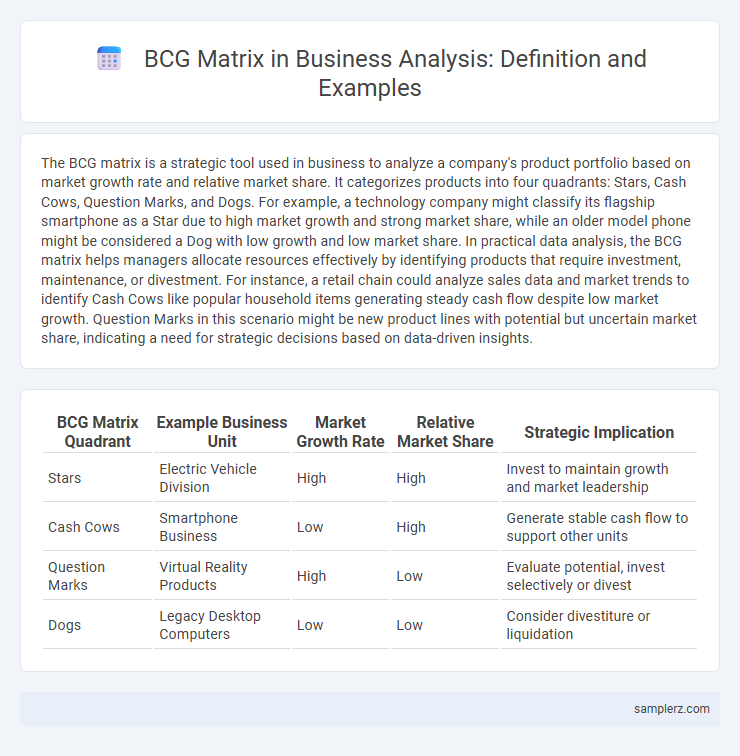

Table of Comparison

| BCG Matrix Quadrant | Example Business Unit | Market Growth Rate | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Stars | Electric Vehicle Division | High | High | Invest to maintain growth and market leadership |

| Cash Cows | Smartphone Business | Low | High | Generate stable cash flow to support other units |

| Question Marks | Virtual Reality Products | High | Low | Evaluate potential, invest selectively or divest |

| Dogs | Legacy Desktop Computers | Low | Low | Consider divestiture or liquidation |

Introduction to BCG Matrix in Business Analysis

The BCG Matrix categorizes a company's business units or products into four quadrants: Stars, Cash Cows, Question Marks, and Dogs, based on market growth rate and relative market share. This strategic tool helps businesses prioritize investments by identifying high-growth opportunities and underperforming assets. Companies like Apple use the BCG Matrix to allocate resources efficiently, balancing innovation-driven products with established revenue generators.

Understanding the Four Quadrants of the BCG Matrix

The BCG matrix divides products into four quadrants: Stars, Cash Cows, Question Marks, and Dogs, based on market growth and relative market share. Stars represent high-growth, high-share businesses requiring investment to sustain growth, while Cash Cows generate steady cash flow with low growth in mature markets. Question Marks have high growth but low market share, demanding strategic decisions for growth potential, and Dogs hold low market share in low-growth markets, often considered for divestment.

Example of a Cash Cow: Case Study Overview

Apple Inc.'s iPhone represents a classic Cash Cow in the BCG matrix due to its high market share in a mature smartphone market. The iPhone consistently generates substantial revenue and profits, funding Apple's innovation and expansion into other business areas. This steady cash flow supports Apple's long-term strategic investments while maintaining dominance in a saturated industry.

Example of a Star: Driving Business Growth

A Star in the BCG matrix represents a business unit with high market share in a rapidly growing industry, driving significant growth. For example, Apple's iPhone division exemplifies a Star, as it commands a leading position in expanding smartphone markets, generating substantial revenue and requiring continued investment to sustain growth. This strategic focus enables companies to capitalize on market momentum and strengthen their competitive advantage.

Example of a Question Mark: Navigating Uncertainty

A classic example of a Question Mark in the BCG matrix is Tesla's early electric vehicle division, which showed high market growth but held a relatively small market share amid intense competition. This position required strategic investment decisions to either increase market share or divest, reflecting the uncertainty inherent in rapidly evolving industries. Effective management of Question Marks can lead to future Stars or, if mismanaged, result in costly divestments.

Example of a Dog: Handling Low-Performing Products

In the BCG matrix, a Dog represents a low market share and low market growth product, often exemplified by outdated technology gadgets in a company's portfolio. These products typically drain resources without significant returns, requiring strategic decisions such as divestment, discontinuation, or repositioning. Efficient handling of Dogs involves minimizing investment while exploring niche markets or cost-cutting measures to improve profitability or prepare for exit.

Step-by-Step Guide: Conducting a BCG Matrix Analysis

Identify business units or products and categorize them based on market growth rate and relative market share to position them within the BCG matrix's four quadrants: Stars, Cash Cows, Question Marks, and Dogs. Gather relevant market data, including sales volume, market trends, and competitor performance, to accurately assess each unit's market growth and share. Analyze the matrix to develop strategic recommendations such as investing in Stars, maintaining Cash Cows, deciding whether to increase resources or divest Question Marks, and phasing out Dogs.

Real-World Application: BCG Matrix in a Leading Company

Apple Inc. utilizes the BCG matrix to manage its product portfolio by categorizing iPhone as a star due to its high market share and growth, while products like the iPod are considered dogs with low growth and market share. Mac computers represent cash cows, generating consistent revenue in a mature market, enabling Apple to invest in new innovations. This strategic application of the BCG matrix guides resource allocation and long-term planning for sustained competitive advantage.

Key Benefits of Using the BCG Matrix in Strategic Planning

The BCG matrix categorizes business units into Stars, Cash Cows, Question Marks, and Dogs, aiding companies in resource allocation and investment decisions. It enhances strategic planning by identifying growth opportunities, optimizing portfolio management, and balancing risk versus return. This tool improves decision-making efficiency, ensuring sustained business growth and competitiveness in dynamic markets.

Best Practices and Common Pitfalls in BCG Matrix Analysis

Effective BCG matrix analysis relies on accurately categorizing business units into Stars, Cash Cows, Question Marks, and Dogs based on market growth rate and relative market share, ensuring strategic focus aligns with resource allocation. Best practices include regularly updating data to reflect market changes and combining the matrix with other analytical tools to avoid oversimplification of complex business scenarios. Common pitfalls involve neglecting external factors like competitive dynamics and market trends, which can lead to misclassification and suboptimal strategic decisions.

example of BCG matrix in analysis Infographic

samplerz.com

samplerz.com