Keiretsu is a Japanese business model characterized by a network of interlinked corporations that hold shares in each other to promote mutual stability and growth. A prominent example of keiretsu can be seen in the Mitsubishi Group, which consists of various independent companies including Mitsubishi Motors, Mitsubishi Heavy Industries, and Mitsubishi UFJ Financial Group. These companies collaborate closely through cross-shareholding structures and shared business interests, strengthening their competitive advantage in the global market. Another significant example is the Toyota Group, where Toyota Motor Corporation leads a network of suppliers, manufacturers, and financial institutions. This keiretsu includes companies like Denso, Aisin Seiki, and Toyota Tsusho, which support Toyota's supply chain and innovation processes. The keiretsu system facilitates coordination, risk-sharing, and long-term partnerships that enhance operational efficiency and business resilience.

Table of Comparison

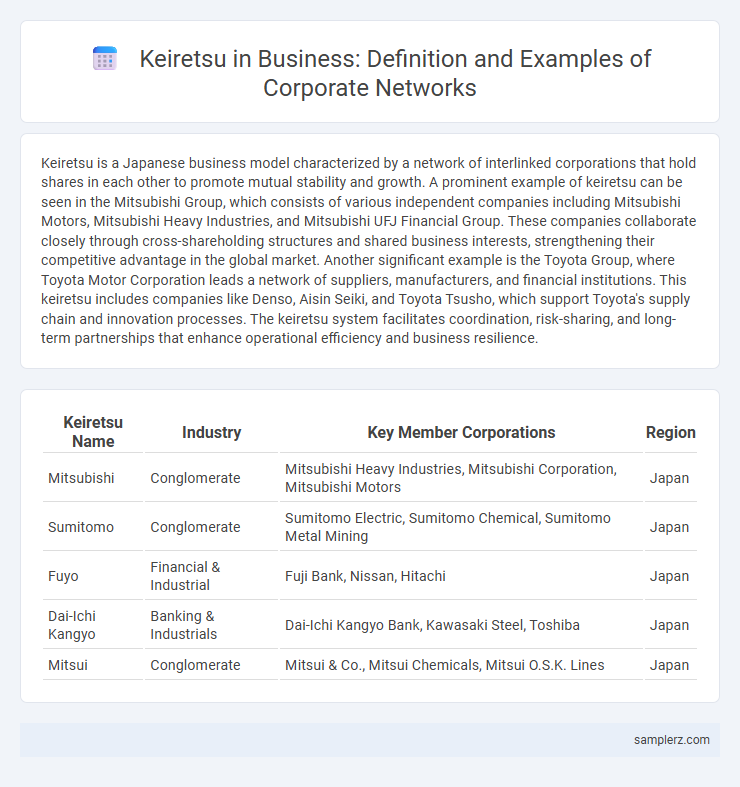

| Keiretsu Name | Industry | Key Member Corporations | Region |

|---|---|---|---|

| Mitsubishi | Conglomerate | Mitsubishi Heavy Industries, Mitsubishi Corporation, Mitsubishi Motors | Japan |

| Sumitomo | Conglomerate | Sumitomo Electric, Sumitomo Chemical, Sumitomo Metal Mining | Japan |

| Fuyo | Financial & Industrial | Fuji Bank, Nissan, Hitachi | Japan |

| Dai-Ichi Kangyo | Banking & Industrials | Dai-Ichi Kangyo Bank, Kawasaki Steel, Toshiba | Japan |

| Mitsui | Conglomerate | Mitsui & Co., Mitsui Chemicals, Mitsui O.S.K. Lines | Japan |

Understanding Keiretsu: A Brief Overview

Keiretsu exemplifies a unique business network primarily found in Japan, where corporations interlink through cross-shareholding and long-term partnerships to ensure mutual stability and growth. Prominent examples include the Mitsubishi and Sumitomo groups, which encompass diverse industries such as finance, manufacturing, and trading, reinforcing competitive advantage and resilience. This interconnected structure enhances resource sharing, risk management, and coordinated strategies among member firms, distinguishing keiretsu from Western corporate alliances.

Historical Origins of Keiretsu in Japan

Keiretsu originated in Japan during the post-World War II era as a restructuring of pre-war zaibatsu conglomerates, forming tightly knit groups of corporations linked by cross-shareholdings and coordinated through a central bank. Prominent examples include the Mitsubishi, Sumitomo, and Mitsui keiretsu, which played critical roles in Japan's rapid industrial growth by facilitating long-term business relationships and stable financing. These keiretsu networks historically contributed to Japan's economic resilience and corporate governance by fostering trust and collaboration among member companies.

Key Characteristics of Keiretsu Networks

Keiretsu networks in business exemplify tightly-knit groups of companies with interlocking shareholdings and long-term business relationships, fostering stability and mutual trust. These corporate alliances often include manufacturers, suppliers, and distributors collaborating closely to enhance supply chain efficiency and innovation. Key characteristics include coordinated decision-making, cross-shareholding to prevent hostile takeovers, and shared resources that strengthen competitive advantage and resilience.

Mitsubishi Group: A Classic Keiretsu Example

The Mitsubishi Group exemplifies a classic keiretsu structure, featuring a network of interlinked corporations with cross-shareholdings that foster long-term business stability and collaboration. This keiretsu includes key companies such as Mitsubishi Motors, Mitsubishi Electric, and Mitsubishi Heavy Industries, which coordinate in manufacturing, finance, and trading sectors to leverage collective strengths. The group's closely-knit alliance supports risk-sharing, innovation, and mutual growth, demonstrating the strategic benefits of Japan's traditional corporate conglomerates.

Toyota Group: Leveraging Keiretsu for Supply Chain Excellence

Toyota Group exemplifies keiretsu through its tightly integrated network of suppliers, manufacturers, and distributors collaborating to enhance supply chain efficiency. The group's cross-shareholding arrangements and long-term partnerships foster mutual trust and innovation, enabling just-in-time production and high-quality output. This strategic keiretsu model reduces costs, minimizes inventory risks, and strengthens resilience against market fluctuations.

Sumitomo Group: Diversification and Stability in Keiretsu

Sumitomo Group exemplifies keiretsu through its extensive diversification across industries such as mining, banking, electronics, and chemical manufacturing, creating a robust network of interlinked companies. This structure ensures financial stability and operational synergy, enabling shared resources and long-term cooperation among its affiliates. The group's cohesive management approach fosters risk mitigation and sustainable growth, distinguishing it as a model of stability within Japan's keiretsu systems.

The Role of Financial Keiretsu in Japanese Banking

Financial keiretsu in Japanese banking exemplify intricate networks of cross-shareholding among banks, insurance companies, and industrial firms, fostering long-term business relationships. The Mitsubishi, Sumitomo, and UFJ financial groups illustrate how these alliances enable stable capital flow, risk sharing, and coordinated corporate governance. This system supports Japan's economic resilience by enhancing trust and collaboration among member institutions.

Industrial Keiretsu: Collaboration in Manufacturing

Industrial keiretsu such as the Mitsubishi Group demonstrate strong collaboration in manufacturing by integrating suppliers, manufacturers, and distributors within a network to enhance efficiency and innovation. This inter-corporate alliance optimizes supply chain management, reduces costs, and accelerates product development across sectors like automotive, heavy machinery, and electronics. The coordinated efforts within Mitsubishi Industrial Keiretsu foster long-term partnerships, resource sharing, and strategic investments, driving competitive advantage in global markets.

Keiretsu vs. Western Corporate Alliances

Keiretsu, a Japanese business network consisting of interconnected companies linked through cross-shareholdings and long-term partnerships, contrasts sharply with Western corporate alliances, which tend to be more contractual and project-based. Prominent examples of keiretsu include the Mitsubishi and Toyota groups, where member firms collaborate closely across manufacturing, finance, and distribution to enhance mutual stability and competitive advantage. Unlike Western alliances that prioritize flexibility and market-driven partnerships, keiretsu emphasizes trust, collective decision-making, and enduring relationships fostering resilience during economic fluctuations.

Modern Evolution and Global Impact of Keiretsu

The modern evolution of keiretsu is exemplified by corporations like Toyota, where tightly-knit networks of suppliers, manufacturers, and distributors enhance innovation and supply chain resilience in a global market. These keiretsu structures promote long-term partnerships and collaborative investments, driving competitive advantages in international business environments. Their global impact is evident in how such alliances facilitate cross-border technological exchanges, streamline operations, and support sustainable growth across multiple industries.

example of keiretsu in corporation Infographic

samplerz.com

samplerz.com