A common example of a skimmer in an ATM is a small, deceptive device placed over the card slot. This device captures the magnetic stripe data from inserted cards, allowing criminals to clone cards without the owner's knowledge. The skimmer often has a built-in camera or keypad overlay to record PIN entries, increasing the risk of identity theft and financial loss. Data from security reports indicate that ATM skimming incidents have surged globally, with over 50,000 cases reported annually. Law enforcement agencies have identified specific skimmer models designed for use in high-traffic locations, emphasizing the importance of vigilance. Entities managing ATMs are deploying advanced anti-skimming technologies and educating users on safe practices to mitigate these threats.

Table of Comparison

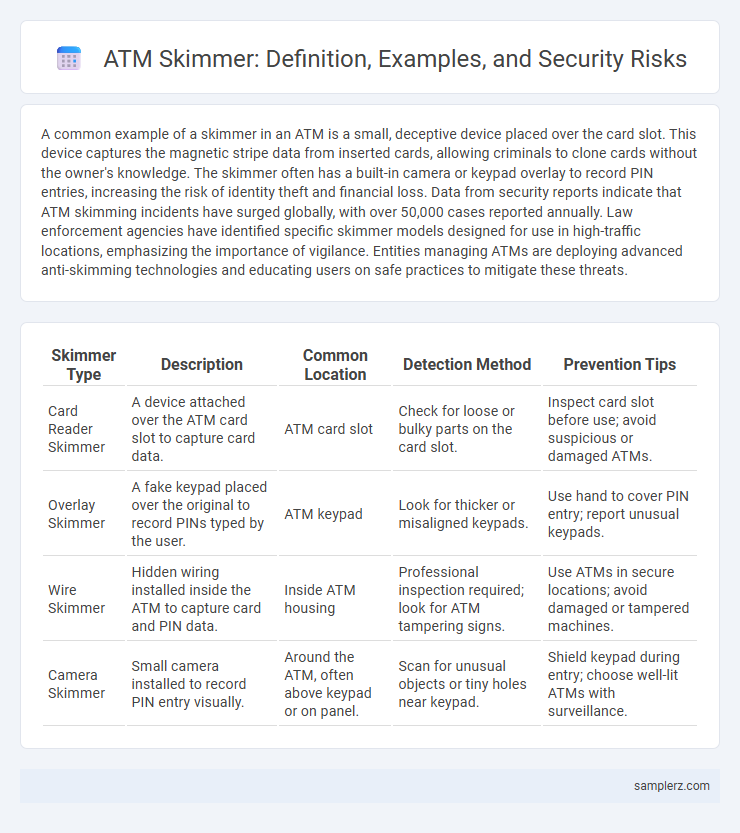

| Skimmer Type | Description | Common Location | Detection Method | Prevention Tips |

|---|---|---|---|---|

| Card Reader Skimmer | A device attached over the ATM card slot to capture card data. | ATM card slot | Check for loose or bulky parts on the card slot. | Inspect card slot before use; avoid suspicious or damaged ATMs. |

| Overlay Skimmer | A fake keypad placed over the original to record PINs typed by the user. | ATM keypad | Look for thicker or misaligned keypads. | Use hand to cover PIN entry; report unusual keypads. |

| Wire Skimmer | Hidden wiring installed inside the ATM to capture card and PIN data. | Inside ATM housing | Professional inspection required; look for ATM tampering signs. | Use ATMs in secure locations; avoid damaged or tampered machines. |

| Camera Skimmer | Small camera installed to record PIN entry visually. | Around the ATM, often above keypad or on panel. | Scan for unusual objects or tiny holes near keypad. | Shield keypad during entry; choose well-lit ATMs with surveillance. |

Understanding ATM Skimming: A Growing Security Threat

ATM skimming involves installing a discreet card reader over the ATM's slot to capture card information during genuine transactions, often paired with a hidden camera recording PIN entries. This evolving technique exploits physical vulnerabilities, compromising user data and enabling unauthorized access to bank accounts. Understanding the mechanics of ATM skimmers is critical for enhancing security measures and protecting against financial fraud.

Common Types of ATM Skimmers and How They Operate

Common types of ATM skimmers include overlay skimmers, which attach visibly over the card slot to capture data, and deep insert skimmers that are inserted inside the card reader, remaining hidden from view. These devices operate by reading and storing magnetic stripe information from inserted cards, while some advanced skimmers are equipped with small cameras or keypad overlays to capture PIN codes. Criminals often retrieve the skimmer later to download stolen card details, enabling fraudulent transactions and identity theft.

Real-World Cases of ATM Skimmer Attacks

Real-world cases of ATM skimmer attacks often involve criminals attaching discreet card readers over legitimate card slots to steal customer data. High-profile incidents, such as the 2018 global ATM skimming surge, revealed cloned card usage resulting in millions of dollars in fraudulent withdrawals. Advanced skimming devices now combine PIN capture cameras and Bluetooth transmitters, increasing the sophistication and frequency of these cyber-financial threats.

How Criminals Install Skimmers on ATMs

Criminals install skimmers on ATMs by attaching a small, discreet device over or inside the card slot, designed to capture card data during transactions. They often tamper with the ATM's keypad to record PIN entries using tiny cameras or fake keypads. These skimmers can be installed quickly, sometimes by exploiting poorly monitored or unattended ATMs in convenience stores or gas stations, allowing criminals to steal card information without immediate detection.

signals and Warning Signs of an ATM Skimmer

ATM skimmer devices emit unusual magnetic or electronic signals that can interfere with the machine's card reader functionality, often detected by abnormal blinking lights or inconsistent keypad responses. Warning signs include physical alterations around the card slot such as loose or bulky attachments, scratch marks, and misaligned panels, which can indicate the presence of a skimmer. Users should also be cautious of hidden cameras positioned near the PIN pad or unusual coverings that obscure the machine's authentic features.

Physical vs. Digital ATM Skimming Devices

ATM skimming devices can be categorized into physical and digital types, each targeting the integrity of cardholder data differently. Physical skimmers are external attachments placed over the card slot to capture card details through embedded microchips or cameras, while digital skimmers use malware to infiltrate ATM software and extract PINs and account information. Understanding these distinctions enhances security measures by enabling tailored countermeasures against hardware tampering and software breaches.

Steps to Detect Skimmers on ATMs

To detect skimmers on ATMs, closely inspect the card reader for any unusual attachments or bulges that differ from the machine's original design. Check for loose parts, scratches, or adhesive residue around the keypad and card slot, as skimmers often require tampering to install. Use your hand to wiggle the card slot and keypad; a skimmer device may feel loose or movable compared to a secure ATM panel.

Impact of ATM Skimming on Victims and Banks

ATM skimming results in unauthorized theft of card information, leading to significant financial losses for victims and increased fraud liability for banks. Victims often face disrupted credit, time-consuming recovery processes, and emotional distress from identity theft and drained accounts. Banks endure reputational damage, regulatory fines, and costly implementation of enhanced security measures to combat escalating skimming attacks.

Preventative Measures Against ATM Skimmer Fraud

Installing anti-skimming devices such as jamming technology and shroud extensions on ATM card slots significantly reduces the risk of unauthorized data capture. Regularly updating ATM software and conducting frequent physical inspections help identify and remove skimming devices promptly. Educating users to verify ATM integrity and shield PIN entries further strengthens defenses against skimmer fraud.

Reporting Suspected ATM Skimming Incidents

Reporting suspected ATM skimming incidents immediately to financial institutions or local authorities helps prevent further fraud and protects users' accounts. Capturing details such as the ATM location, time of the incident, and any unusual card reader attachments strengthens investigation accuracy. Prompt reporting supports swift action to disable compromised machines and enhances overall ATM security protocols.

example of skimmer in ATM Infographic

samplerz.com

samplerz.com