A mantrap in a bank is a physical security system designed to control access between two secure areas. Typically, it consists of a small room with two interlocking doors where the first door must close before the second opens. This setup prevents unauthorized individuals from gaining entry, ensuring only one person can pass through at a time. Banks use mantraps to protect sensitive areas such as vaults or teller sections where large sums of money or sensitive data are stored. Security features often include biometric scanners, card readers, and surveillance cameras to verify identity and monitor activity. Mantraps establish an added layer of security, reducing the risk of theft and unauthorized access.

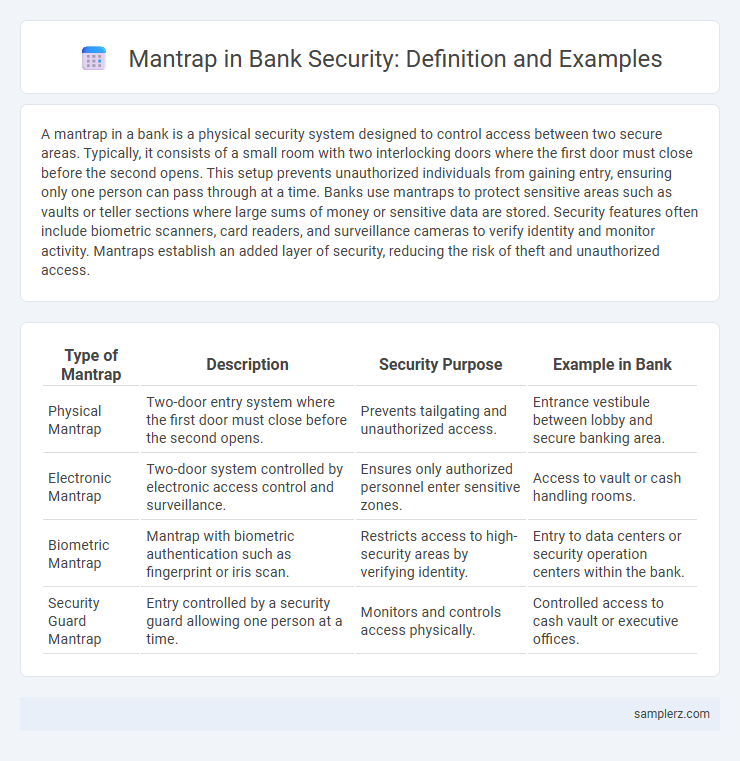

Table of Comparison

| Type of Mantrap | Description | Security Purpose | Example in Bank |

|---|---|---|---|

| Physical Mantrap | Two-door entry system where the first door must close before the second opens. | Prevents tailgating and unauthorized access. | Entrance vestibule between lobby and secure banking area. |

| Electronic Mantrap | Two-door system controlled by electronic access control and surveillance. | Ensures only authorized personnel enter sensitive zones. | Access to vault or cash handling rooms. |

| Biometric Mantrap | Mantrap with biometric authentication such as fingerprint or iris scan. | Restricts access to high-security areas by verifying identity. | Entry to data centers or security operation centers within the bank. |

| Security Guard Mantrap | Entry controlled by a security guard allowing one person at a time. | Monitors and controls access physically. | Controlled access to cash vault or executive offices. |

Introduction to Mantraps in Bank Security

Mantraps in bank security function as physical access control systems designed to prevent unauthorized entry by allowing only one person to pass through a secure area at a time. These enclosed spaces feature two interlocking doors where the first door must close before the second unlocks, effectively mitigating tailgating and piggybacking risks. High-security banks utilize mantraps integrated with biometric scanners, card readers, and surveillance cameras to enhance authentication and monitoring within restricted zones.

How Mantraps Enhance Bank Entry Control

Mantraps in banks create a secure vestibule that allows only one individual to pass at a time, significantly reducing the risk of unauthorized access. By integrating biometric scanners and RFID card readers within the mantrap, banks ensure robust identity verification before granting entry. These controlled entry points enhance surveillance and delay intruders, providing security personnel crucial response time.

Physical Design Features of Bank Mantraps

Bank mantraps integrate reinforced steel doors on both entry and exit points, creating a secure vestibule that controls access to sensitive areas. Transparent bullet-resistant glass panels allow visual verification while maintaining strong physical barriers. Additionally, biometric authentication systems and anti-tailgating sensors enhance security by permitting entry only to authorized personnel, ensuring strict access control within the mantrap.

Real-World Example: Mantrap Implementation in Major Banks

Major banks implement mantraps as a critical security measure to control access between public areas and secure zones such as vaults and data centers. These double-door entry systems require biometric authentication and identity verification before granting passage, significantly reducing unauthorized access risks. Mantraps in banks often integrate with surveillance systems and security personnel protocols to ensure real-time monitoring and rapid response to potential breaches.

Preventing Unauthorized Access with Mantraps

Mantraps in banks serve as a critical security measure by creating a controlled access point that detains individuals between two locked doors, preventing tailgating and unauthorized entry. These physical barriers are often equipped with biometric scanners or keycard readers to authenticate users before granting access to secure areas like vaults or data rooms. By restricting access through layered authentication and isolation, mantraps significantly mitigate the risk of security breaches and enhance the bank's overall protection against intrusions.

Integrating Biometric Authentication in Bank Mantraps

Mantraps in banks enhance security by integrating biometric authentication systems such as fingerprint scanners or iris recognition, ensuring only authorized personnel gain access to sensitive areas. This dual-authentication mechanism mitigates risks of tailgating and unauthorized entry by verifying identities through unique physiological traits. Banks employing biometric mantraps report reduced security breaches and increased protection of vaults and data centers.

Case Study: Foiling Robbery Attempts Using Mantraps

Mantraps installed at bank entrances served as a critical security layer, effectively preventing unauthorized access during attempted robberies. In one documented case, the mantrap's dual-door system trapped would-be robbers between compartments, allowing security personnel to intervene swiftly without risk. This approach not only enhanced physical security but also minimized potential losses by delaying intruders and enabling rapid response.

Regulatory Compliance and Mantrap Usage in Banks

Mantraps in banks serve as critical security measures to ensure regulatory compliance with standards such as the Gramm-Leach-Bliley Act (GLBA) and Payment Card Industry Data Security Standard (PCI DSS). These controlled access points prevent unauthorized entry by verifying customer identity through multi-factor authentication before granting access to sensitive areas containing vaults or data centers. Proper implementation of mantraps helps banks mitigate risks of insider threats and physical breaches, maintaining the confidentiality and integrity of financial assets and customer information.

Challenges of Maintaining Mantraps in Financial Institutions

Maintaining mantraps in financial institutions presents challenges such as ensuring seamless integration with existing security systems and managing the risk of system malfunctions that could trap authorized personnel or allow unauthorized access. Rigorous maintenance schedules and real-time monitoring are essential to prevent mechanical failures and mitigate downtime, which could disrupt banking operations. Financial institutions also face the challenge of balancing tight security protocols with customer convenience to avoid creating bottlenecks or negative user experiences.

Future Trends: Advancements in Mantrap Technology for Banks

Next-generation mantrap systems in banks incorporate biometric authentication, AI-driven behavior analysis, and real-time threat detection to enhance security protocols. Integration with IoT devices enables seamless access control and monitoring, reducing unauthorized entry risks. Predictive analytics combined with advanced sensor technologies are poised to revolutionize secure entry points by proactively identifying suspicious activities.

example of mantrap in bank Infographic

samplerz.com

samplerz.com