Amortization in real estate financing refers to the process of spreading out loan payments over a specific period, typically through fixed monthly installments that cover both principal and interest. For example, a borrower taking a $300,000 mortgage with a 30-year amortization schedule will make consistent payments designed to fully repay the loan by the end of the term. Each payment reduces the principal balance while covering interest accrued on the outstanding loan amount. The amortization schedule provides a detailed breakdown showing how much of each payment contributes to principal reduction versus interest expense. Early in the loan term, interest comprises a larger portion of monthly payments, while principal repayment accelerates in later years. This structured approach helps borrowers understand the cost of financing and plan their long-term real estate investment strategies effectively.

Table of Comparison

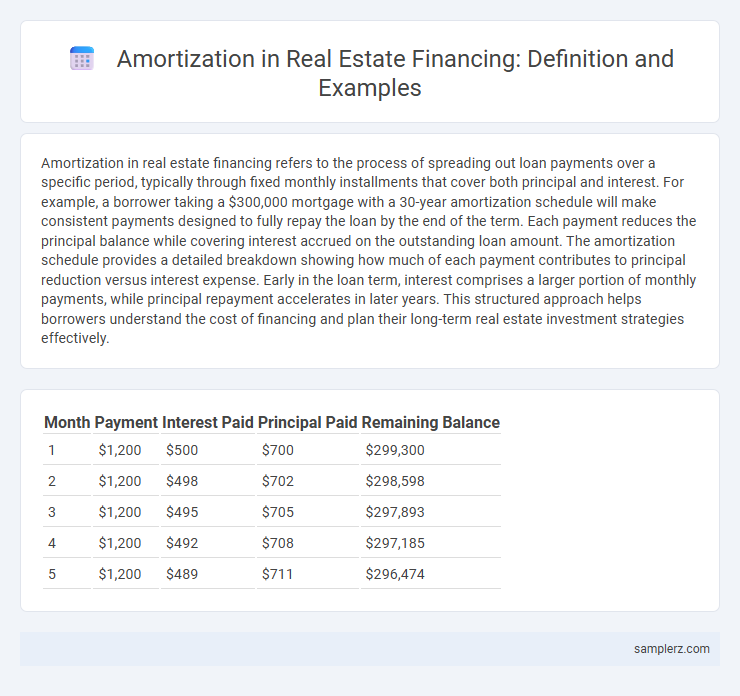

| Month | Payment | Interest Paid | Principal Paid | Remaining Balance |

|---|---|---|---|---|

| 1 | $1,200 | $500 | $700 | $299,300 |

| 2 | $1,200 | $498 | $702 | $298,598 |

| 3 | $1,200 | $495 | $705 | $297,893 |

| 4 | $1,200 | $492 | $708 | $297,185 |

| 5 | $1,200 | $489 | $711 | $296,474 |

Understanding Amortization in Real Estate Financing

Amortization in real estate financing involves spreading loan payments over a set period, combining principal and interest to gradually reduce the mortgage balance. A common example is a 30-year fixed-rate mortgage where monthly payments are calculated to pay off the loan completely by the end of the term. Understanding this process helps buyers anticipate costs, manage budgets, and build equity effectively over time.

Key Components of an Amortization Schedule

An amortization schedule in real estate financing breaks down each loan payment into principal and interest components, illustrating how the loan balance decreases over time. Key components include the payment number, payment amount, portion applied to principal, portion applied to interest, and remaining loan balance after each payment. This schedule helps borrowers understand the gradual equity buildup and the total interest cost throughout the mortgage term.

How Amortization Impacts Monthly Mortgage Payments

Amortization is the process of spreading out a loan into a series of fixed monthly payments over a specified period, typically 15 or 30 years in real estate financing. The longer the amortization period, the lower the monthly mortgage payments will be, but this results in higher total interest paid over the life of the loan. Understanding amortization schedules helps homeowners see how much principal versus interest is included in each monthly payment, affecting both cash flow and long-term equity building.

Real-World Example: Amortizing a 30-Year Fixed Mortgage

A 30-year fixed mortgage with a principal of $300,000 and an interest rate of 4% results in a monthly payment of approximately $1,432, covering both principal and interest. Over the first few years, most of the payment primarily reduces interest, with only a small portion lowering the principal balance. As payments continue, the amortization schedule gradually shifts, increasing principal repayment and decreasing interest, fully paying off the loan by the end of the 30-year term.

Principal vs. Interest: Breaking Down Each Payment

Each mortgage payment consists of principal and interest components, with the initial payments primarily covering interest while a smaller portion reduces the principal balance. Over time, the amortization schedule shifts, increasing the principal repayment and decreasing interest as the loan matures. This gradual reallocation accelerates equity building in the property and reduces the outstanding loan balance consistently.

Amortization and Its Effect on Home Equity Growth

Amortization in real estate financing involves gradually paying off a mortgage through regular principal and interest payments over a set term, typically 15 to 30 years. As the loan amortizes, the portion of each payment allocated to principal increases, accelerating home equity growth by reducing the outstanding loan balance. Understanding amortization schedules helps homeowners predict their equity buildup and make informed decisions on refinancing or additional principal payments to enhance investment returns.

Common Types of Amortized Real Estate Loans

Common types of amortized real estate loans include fixed-rate mortgages, adjustable-rate mortgages (ARMs), and interest-only loans. Fixed-rate mortgages feature consistent monthly payments over a set term, typically 15 or 30 years, allowing borrowers to gradually reduce principal and interest. Adjustable-rate mortgages offer variable interest rates that adjust periodically, providing lower initial payments that increase or decrease based on market conditions.

Early Repayment: Impact on Amortization Schedules

Early repayment in real estate financing significantly alters amortization schedules by reducing the outstanding principal faster, which decreases the total interest paid over the loan term. When a borrower makes an early lump-sum payment, the monthly installments can either be reduced or the loan term shortened depending on the lender's policy. This adjustment accelerates equity buildup in the property and can enhance financial flexibility for the homeowner.

Amortization Comparisons: Fixed vs. Adjustable-Rate Mortgages

Fixed-rate mortgages maintain consistent monthly payments over the loan term, simplifying budgeting and ensuring stable amortization schedules. Adjustable-rate mortgages start with lower initial payments but can fluctuate based on market interest rates, causing variable amortization amounts and potential payment increases. Comparing amortization schedules highlights that fixed-rate loans offer predictable equity buildup, whereas adjustable-rate loans may accelerate or slow principal repayment depending on rate adjustments.

Tools and Calculators for Estimating Amortization

Amortization calculators simplify real estate financing by providing detailed payment schedules based on loan amount, interest rate, and term length, enabling precise estimation of principal and interest breakdowns. Online tools such as mortgage amortization calculators and Excel templates allow users to visualize amortization curves and track loan balance reductions over time. These calculators enhance financial planning by projecting total interest costs and helping buyers compare different loan options effectively.

example of amortization in financing Infographic

samplerz.com

samplerz.com