A co-op in real estate refers to a housing arrangement where residents own shares in a corporation that owns the entire property. Instead of owning individual units, shareholders have the right to occupy a specific apartment within the building. This structure allows for shared maintenance costs and collective decision-making among residents. Co-ops are common in urban areas such as New York City and San Francisco, where space and property ownership models differ from traditional condominiums. Shareholders often undergo a rigorous approval process before purchasing shares, ensuring community compatibility. The value of co-op shares typically fluctuates based on the building's financial health and real estate market trends.

Table of Comparison

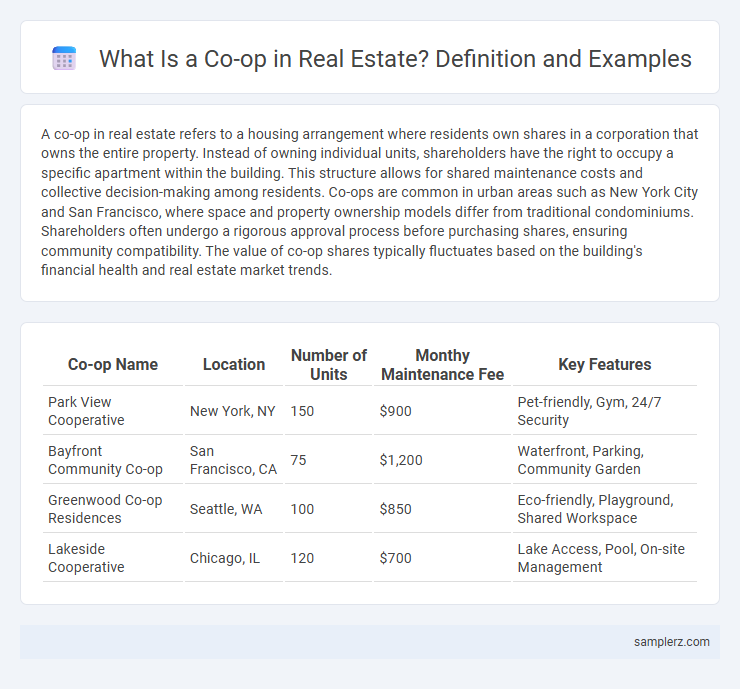

| Co-op Name | Location | Number of Units | Monthy Maintenance Fee | Key Features |

|---|---|---|---|---|

| Park View Cooperative | New York, NY | 150 | $900 | Pet-friendly, Gym, 24/7 Security |

| Bayfront Community Co-op | San Francisco, CA | 75 | $1,200 | Waterfront, Parking, Community Garden |

| Greenwood Co-op Residences | Seattle, WA | 100 | $850 | Eco-friendly, Playground, Shared Workspace |

| Lakeside Cooperative | Chicago, IL | 120 | $700 | Lake Access, Pool, On-site Management |

What is a Co-op in Real Estate?

A co-op in real estate refers to a cooperative housing arrangement where residents own shares in a corporation that owns the entire property, rather than owning their individual units outright. This structure allows residents to have a proprietary lease or occupancy agreement for their specific apartment, with decision-making power vested in a board of directors elected by shareholders. Co-ops typically require board approval for purchases, emphasizing community control and shared responsibility among residents.

Key Features of Co-op Properties

Co-op properties typically involve ownership of shares in a corporation that owns the building, granting residents proprietary leases to their units. Key features include stringent board approval processes, monthly maintenance fees covering building expenses, and restrictions on subletting or renovations to maintain building standards. These characteristics create a community-focused living environment with shared financial and operational responsibilities.

How Co-ops Differ from Condos and Apartments

Co-ops in real estate differ significantly from condos and apartments by requiring residents to purchase shares in a cooperative corporation rather than owning their individual units outright. Unlike condos, where ownership includes the physical unit and shared common areas, co-op residents hold proprietary leases granting the right to occupy a unit, subject to board approval and strict financial requirements. Apartments are typically rental units owned by landlords, whereas co-op ownership involves collective decision-making and shared financial responsibility among shareholders.

Notable Examples of Co-op Buildings

Notable examples of co-op buildings in real estate include iconic New York City residences like 740 Park Avenue and the Dakota, known for their prestigious co-op boards and exclusive ownership structures. These co-op buildings manage shareholder rights and responsibilities through a cooperative corporation, allowing residents to control property decisions and maintain high standards. The cooperative model in such buildings often results in increased privacy, stringent financial vetting, and a strong sense of community among shareholders.

The Co-op Purchasing Process Explained

The co-op purchasing process involves buyers applying to a cooperative housing corporation, which owns the entire property, rather than purchasing individual units. Prospective buyers submit an application, attend interviews with the co-op board, and obtain board approval before completing the transaction. This process typically includes a thorough financial review and adherence to strict guidelines, making it distinct from traditional real estate purchases.

Pros and Cons of Living in a Co-op

Living in a co-op offers advantages such as lower purchase prices compared to condos, shared maintenance costs, and a strong sense of community due to collective ownership. However, co-op residents face strict approval processes, limited financing options, and potential restrictions on subletting or renovations imposed by the cooperative board. Understanding these pros and cons is essential for buyers considering co-op apartments in competitive real estate markets.

Financial Requirements for Co-op Ownership

Co-op ownership typically requires a substantial down payment, often ranging from 20% to 30% of the purchase price, along with proof of stable income and strong credit history. Many co-ops also impose strict debt-to-income ratio limits and may require liquid assets to cover several months of maintenance fees or mortgage payments. Prospective buyers need to prepare detailed financial documents, including tax returns, bank statements, and employment verification, to meet the co-op board's stringent financial scrutiny.

Understanding Co-op Board Approval

Co-op board approval is a critical step in purchasing a cooperative apartment, requiring prospective buyers to submit detailed financial statements, personal references, and interview with the board. The board evaluates factors such as financial stability, creditworthiness, and compatibility with existing shareholders to ensure community cohesion. Understanding the strict approval process helps buyers prepare thoroughly, increasing the likelihood of acceptance and a smooth transaction.

Co-op Maintenance Fees and Assessments

In a real estate co-op, maintenance fees cover building upkeep, amenities, property taxes, and management salaries, often amounting to several hundred dollars monthly depending on the apartment size and location. Assessments are additional fees charged for major repairs or improvements not included in regular maintenance, such as roof replacement or elevator upgrades, which can be significant and require shareholder approval. Understanding both maintenance fees and potential assessments is crucial for co-op buyers to accurately gauge ongoing and unexpected housing costs.

Tips for Buying a Co-op Apartment

When buying a co-op apartment, thoroughly review the co-op board's financial statements and interview current shareholders to gauge building health and community culture. Secure pre-approval for financing, as lenders often have strict requirements unique to co-op purchases. Pay close attention to the proprietary lease terms and subletting policies to avoid unexpected restrictions after closing.

example of co-op in real estate Infographic

samplerz.com

samplerz.com