Customer Acquisition Cost (CAC) in marketing refers to the total expenses a company incurs to acquire a new customer. This metric includes costs related to advertising, sales team salaries, promotional campaigns, and software tools used for lead generation. For example, if a company spends $50,000 on marketing activities in a month and gains 500 new customers during that period, the CAC would be $100. Marketing teams analyze CAC to evaluate the efficiency of their customer acquisition strategies and optimize budget allocation. A lower CAC often indicates a more cost-effective approach, while a high CAC may signal the need for strategic adjustments in targeting or channels. Tracking CAC in conjunction with Customer Lifetime Value (CLV) helps businesses ensure sustainable growth and profitability.

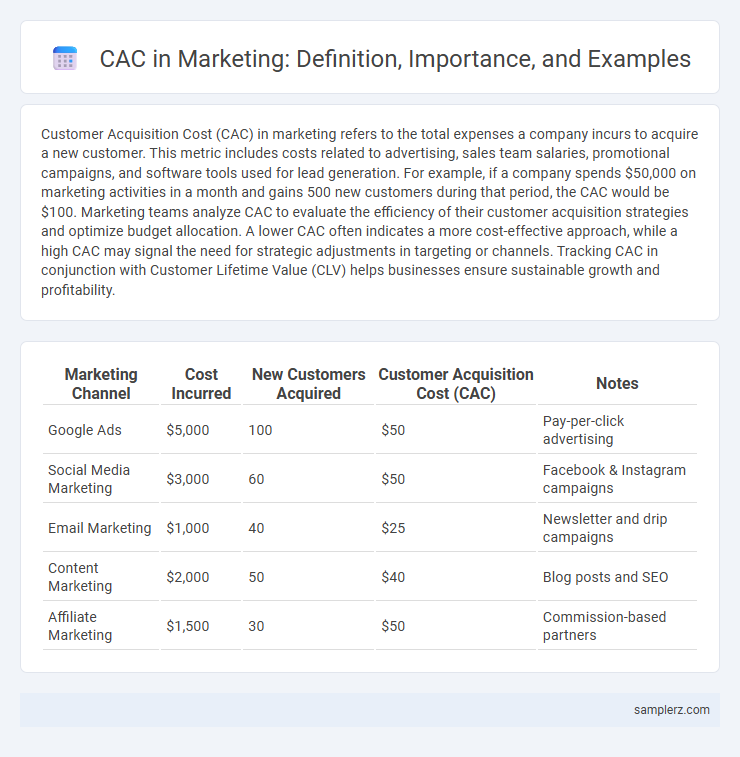

Table of Comparison

| Marketing Channel | Cost Incurred | New Customers Acquired | Customer Acquisition Cost (CAC) | Notes |

|---|---|---|---|---|

| Google Ads | $5,000 | 100 | $50 | Pay-per-click advertising |

| Social Media Marketing | $3,000 | 60 | $50 | Facebook & Instagram campaigns |

| Email Marketing | $1,000 | 40 | $25 | Newsletter and drip campaigns |

| Content Marketing | $2,000 | 50 | $40 | Blog posts and SEO |

| Affiliate Marketing | $1,500 | 30 | $50 | Commission-based partners |

Understanding Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) measures the total marketing and sales expenses required to acquire a new customer, including advertising spend, salaries, and software tools. Calculating CAC involves dividing the total acquisition costs by the number of new customers gained within a specific period, providing insight into marketing efficiency. Understanding CAC helps businesses optimize budgets, improve targeting strategies, and increase overall return on investment (ROI) in marketing campaigns.

Importance of CAC in Marketing Strategies

Customer Acquisition Cost (CAC) measures the total expense incurred to attract and convert a new customer, including marketing and sales costs. Understanding CAC is crucial for optimizing marketing budgets, ensuring campaigns deliver profitable returns, and aligning acquisition costs with customer lifetime value (CLV). Marketers leverage CAC data to refine targeting, tailor messaging, and improve channel allocation for sustainable business growth.

How to Calculate CAC: A Step-by-Step Example

Customer Acquisition Cost (CAC) is calculated by dividing the total marketing and sales expenses by the number of new customers acquired in a specific period. For example, if a company spends $50,000 on marketing campaigns and sales efforts in one month and gains 500 new customers, the CAC is $50,000 divided by 500, resulting in a $100 CAC. This metric helps businesses evaluate the efficiency of their marketing strategies and optimize budget allocation.

Real-World CAC Example in SaaS Marketing

A real-world example of Customer Acquisition Cost (CAC) in SaaS marketing involves a company spending $100,000 per quarter on sales and marketing efforts, which results in acquiring 500 new customers during that period. This calculates to a CAC of $200 per customer, reflecting the total investment divided by the number of new customers acquired. Tracking and optimizing this metric is critical for SaaS businesses to ensure scalable and cost-effective growth strategies.

CAC Example for E-commerce Businesses

Customer Acquisition Cost (CAC) for e-commerce businesses typically includes expenses such as online advertising, influencer partnerships, and email marketing campaigns. For instance, an e-commerce store spending $10,000 on ads and generating 200 new customers will have a CAC of $50 per customer. Tracking and optimizing CAC helps e-commerce companies increase profitability by reducing excessive marketing spend while acquiring quality customers.

Comparing CAC Across Marketing Channels

Comparing Customer Acquisition Cost (CAC) across marketing channels reveals significant variations in cost-efficiency and return on investment, with digital platforms like social media often exhibiting lower CACs compared to traditional channels such as print or TV advertising. Analyzing CAC data enables marketers to allocate budgets toward channels with optimal conversion rates and reduced expenses, thus maximizing overall marketing ROI. Tracking CAC by channel over time provides insights into campaign effectiveness and highlights opportunities for strategic optimization and resource reallocation.

CAC Benchmark Examples by Industry

Customer Acquisition Cost (CAC) varies significantly across industries, with e-commerce typically averaging between $45 and $55 per customer, while SaaS companies often experience CAC ranging from $200 to $300 due to longer sales cycles and higher product complexity. In contrast, financial services report higher CAC benchmarks, frequently exceeding $350, driven by stringent regulations and competitive market dynamics. Understanding these industry-specific CAC benchmarks helps marketers allocate budgets efficiently and refine customer acquisition strategies for optimal return on investment.

CAC Example: Influencer Marketing vs Paid Ads

Customer Acquisition Cost (CAC) in influencer marketing typically ranges from $5 to $30 per customer, depending on the influencer's reach and engagement rates. Paid ads, especially on platforms like Facebook or Google, often see CACs between $10 and $50, influenced by ad quality, targeting precision, and competition. Comparing these, influencer marketing can offer lower CAC for niche audiences, while paid ads provide broader reach but at higher average acquisition costs.

Reducing CAC: Practical Marketing Case Studies

Reducing Customer Acquisition Cost (CAC) is demonstrated effectively in Dropbox's referral program, which leveraged existing users to generate sign-ups at a fraction of traditional marketing expenses. Another practical case is HubSpot's inbound marketing strategy, which decreased CAC by attracting qualified leads through targeted content and SEO optimization. These strategies highlight the impact of customer-centric tactics and organic growth channels in lowering acquisition costs while maintaining high conversion rates.

Common Mistakes in CAC Calculation with Examples

Common mistakes in Customer Acquisition Cost (CAC) calculation include excluding indirect expenses such as marketing salaries and software tools, leading to underestimated costs. For example, a company calculating CAC only by dividing total ad spend by new customers ignores the full investment, skewing profitability analysis. Proper CAC calculation incorporates all relevant expenses to accurately assess marketing efficiency and guide budget allocation.

example of CAC in marketing Infographic

samplerz.com

samplerz.com