A pied-a-terre in real estate refers to a small, secondary residence typically located in a city, used as a convenient urban retreat. These properties are popular among professionals and investors who need a comfortable space for short stays without the commitment of a full-time home. Data shows that pied-a-terre units often range from studios to one-bedroom apartments, optimized for efficiency and minimal upkeep. In major metropolitan areas like New York City, pied-a-terres are sought after for their strategic locations near business districts and cultural landmarks. Market analytics indicate that these properties have a higher rental yield due to consistent demand from corporate tenants and seasonal visitors. Real estate developers increasingly incorporate pied-a-terre options in luxury condominium projects to attract a niche segment of buyers looking for flexible urban living solutions.

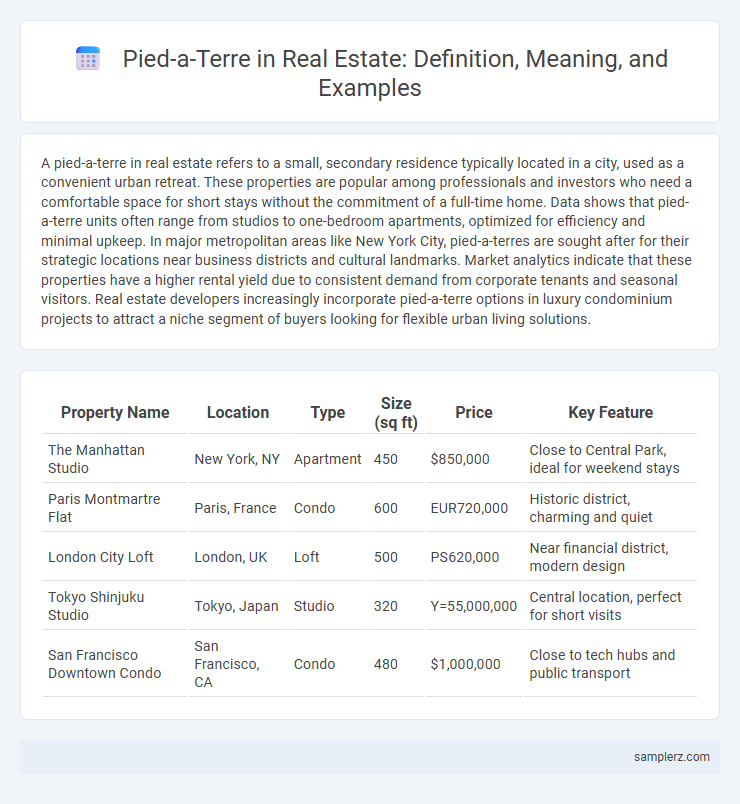

Table of Comparison

| Property Name | Location | Type | Size (sq ft) | Price | Key Feature |

|---|---|---|---|---|---|

| The Manhattan Studio | New York, NY | Apartment | 450 | $850,000 | Close to Central Park, ideal for weekend stays |

| Paris Montmartre Flat | Paris, France | Condo | 600 | EUR720,000 | Historic district, charming and quiet |

| London City Loft | London, UK | Loft | 500 | PS620,000 | Near financial district, modern design |

| Tokyo Shinjuku Studio | Tokyo, Japan | Studio | 320 | Y=55,000,000 | Central location, perfect for short visits |

| San Francisco Downtown Condo | San Francisco, CA | Condo | 480 | $1,000,000 | Close to tech hubs and public transport |

Understanding the Concept of Pied-à-Terre in Real Estate

A pied-a-terre in real estate refers to a small, secondary residence typically located in a city, used as a temporary or weekend retreat. This property type offers convenience for urban professionals or frequent travelers who need a flexible living space close to work, cultural centers, or entertainment hubs. Understanding the concept involves recognizing its value in providing a cost-effective alternative to maintaining a full-time city residence while still enjoying prime urban amenities.

Key Features of a Typical Pied-à-Terre

A typical pied-a-terre is a small, stylish urban apartment designed for occasional use, featuring a compact layout optimized for convenience. Key features often include high-security access, proximity to business districts or cultural hubs, and amenities such as concierge services and fitness centers. These properties balance luxury and practicality, providing an ideal secondary residence for frequent city visitors or professionals.

Popular Cities for Pied-à-Terre Investments

Pied-a-terre properties are highly sought after in popular cities such as New York, Paris, and London, where limited space and high demand create lucrative investment opportunities. These metropolitan areas offer prime locations with easy access to cultural landmarks, business districts, and luxury amenities, attracting investors and professionals who desire convenient secondary residences. Real estate markets in these cities consistently show strong appreciation and rental potential, making pied-a-terre investments a strategic asset in urban portfolios.

How Pied-à-Terre Differs from Regular Second Homes

A pied-a-terre serves as a compact, often urban, secondary residence primarily used for short stays or business trips, unlike regular second homes which are typically larger and located in vacation or rural areas for extended leisure stays. Pieds-a-terre prioritize convenience and proximity to city centers, enabling quick access to work or cultural activities, whereas traditional second homes offer more space and amenities for family vacations or seasonal living. This distinction impacts property choice, interior design, and real estate market demand, often making pieds-a-terre highly sought after in metropolitan luxury markets.

Legal Considerations in Pied-à-Terre Ownership

Pied-a-terre ownership often involves complex legal considerations including zoning laws, condominium association rules, and local tax regulations that vary by jurisdiction. Owners must navigate restrictions on short-term rentals, occupancy limits, and potential capital gains tax implications when selling the property. Understanding these legal frameworks is crucial to ensuring compliance and protecting investment value in metropolitan markets like New York City or San Francisco.

Example of Pied-à-Terre in New York City

In New York City, a pied-a-terre often refers to a small, luxury apartment used as a secondary residence, typically in neighborhoods like Midtown Manhattan or Tribeca. These properties provide convenience for business travelers or seasonal residents seeking proximity to cultural landmarks such as Broadway theaters and fine dining establishments. Real estate listings for pieds-a-terre in NYC highlight features like minimal maintenance, prime location, and access to amenities including concierge services and 24-hour doormen.

Financial Benefits of Owning a Pied-à-Terre

Owning a pied-a-terre in a major metropolitan area can offer significant financial benefits by enabling investors to capitalize on property appreciation and rental income during periods of non-occupancy. These compact urban residences often require lower maintenance and property taxes compared to full-time homes, enhancing cost efficiency. Additionally, the flexibility of a pied-a-terre supports potential tax deductions related to mortgage interest and property expenses, optimizing overall financial returns.

Design and Amenities Common in Pied-à-Terre Properties

Pied-a-terre properties often feature sleek, modern design elements such as open floor plans, floor-to-ceiling windows, and space-saving furniture that maximize limited square footage. Amenities commonly include 24-hour concierge services, fitness centers, rooftop terraces, and secure parking, catering to urban professionals seeking convenience and luxury in city living. High-end finishes like quartz countertops, hardwood floors, and smart home technology enhance functionality and aesthetic appeal in these compact, stylish residences.

Challenges and Restrictions in Pied-à-Terre Purchases

Purchasing a pied-a-terre often encounters challenges such as stringent zoning laws limiting short-term rentals and building regulations that restrict non-primary residence usage. Many cities impose high property taxes and special assessments on secondary residences, increasing the cost burden. Furthermore, community associations may enforce rules that prohibit or tightly control pied-a-terre ownership to preserve neighborhood character and reduce transient occupancy.

Future Trends for Pied-à-Terre Markets

Pied-a-terre properties are increasingly sought after in urban real estate markets like New York City, London, and Paris, driven by remote work flexibility and demand for secondary, low-maintenance residences. Future trends indicate a rise in smart home technology integration and eco-friendly designs tailored to short-term occupancy. Market forecasts predict growth in luxury pied-a-terre developments in high-demand districts, reflecting shifts in lifestyle preferences and investment strategies.

example of pied-à-terre in real estate Infographic

samplerz.com

samplerz.com