A whisper number in marketing refers to the unofficial earnings forecast that circulates among investors and analysts before a company announces its official financial results. This number often deviates from the consensus analyst estimate and reflects insider sentiment or market expectations about a company's upcoming performance. For example, if a technology firm's consensus earnings per share (EPS) is $1.50, but the whisper number is $1.65, investors might anticipate stronger revenue or profit than widely predicted. Companies in sectors like consumer goods and software frequently experience significant attention around whisper numbers due to the impact on stock price movements. Data from earnings seasons shows that deviations between whisper numbers and reported earnings can lead to increased trading volume and volatility. Understanding the difference between whisper numbers and official forecasts helps marketers gauge investor sentiment and tailor communication strategies during earnings announcements.

Table of Comparison

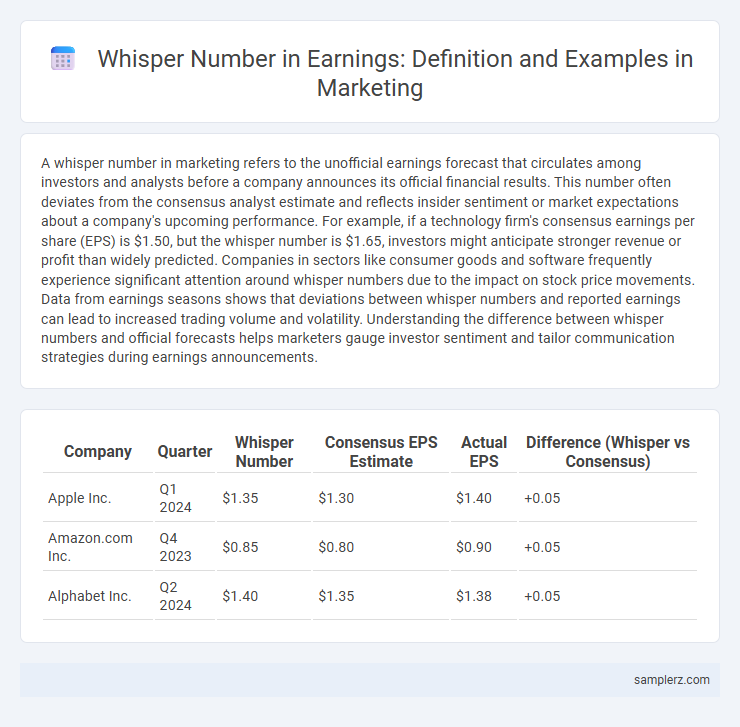

| Company | Quarter | Whisper Number | Consensus EPS Estimate | Actual EPS | Difference (Whisper vs Consensus) |

|---|---|---|---|---|---|

| Apple Inc. | Q1 2024 | $1.35 | $1.30 | $1.40 | +0.05 |

| Amazon.com Inc. | Q4 2023 | $0.85 | $0.80 | $0.90 | +0.05 |

| Alphabet Inc. | Q2 2024 | $1.40 | $1.35 | $1.38 | +0.05 |

Understanding Whisper Numbers in Earnings Reports

Whisper numbers represent unofficial earnings estimates circulated among investors and analysts before a company's official report. These figures often differ from consensus analyst predictions and can significantly influence stock price movements upon earnings announcements. Understanding whisper numbers helps marketers and investors anticipate market reactions and tailor communication strategies effectively.

What are Whisper Numbers?

Whisper numbers represent unofficial earnings forecasts that circulate among investors and analysts before a company's official quarterly earnings announcement. These estimates often differ from consensus analyst projections and can influence market movements when reported earnings align closely with or diverge from these whispered expectations. Tracking whisper numbers helps marketers and investors anticipate market sentiment and adjust strategies accordingly.

The Role of Whisper Numbers in Market Reactions

Whisper numbers, the unofficial earnings estimates shared among traders, significantly influence market reactions by setting investor expectations ahead of official announcements. When a company's reported earnings surpass the whisper number, stock prices often experience a sharp uptick due to positive investor sentiment and perceived undervaluation. Conversely, missing the whisper number typically triggers rapid sell-offs as markets adjust to disappointment beyond standard analyst forecasts.

Real-World Example: Whisper Number vs. Analyst Estimate

Whisper numbers represent unofficial earnings expectations that often differ from analyst estimates, reflecting insider sentiment or market speculation. For example, before Apple's Q1 2024 earnings, the whisper number predicted $3.12 EPS, while analyst consensus stood at $3.05, leading to a stock price surge when actual earnings met the whisper target. This discrepancy highlights how whisper numbers can provide a more accurate forecast of market reaction than traditional analyst estimates in earnings marketing strategies.

How Marketers Can Leverage Whisper Numbers

Marketers can leverage whisper numbers by closely monitoring earnings expectations to fine-tune campaign strategies and budget allocations, ensuring alignment with market sentiment and company performance. By analyzing the gap between whisper numbers and official earnings forecasts, marketers can anticipate shifts in consumer confidence and adjust messaging to capitalize on emerging trends. Utilizing real-time insights from whisper numbers enables more agile marketing decisions, enhancing ROI during earnings season.

Case Study: Impact of Whisper Numbers on Stock Prices

Whisper numbers, the unofficial earnings forecasts circulating among traders, significantly influence stock price volatility around earnings announcements. For example, Tesla's Q3 2023 earnings whisper number of $2.50 per share contrasted with the consensus estimate of $2.35, triggering a 7% intraday stock price surge as investors anticipated stronger performance. This case study highlights how market sentiment driven by whisper numbers can create impactful short-term price movements beyond official analyst predictions.

Sources for Reliable Whisper Numbers

Reliable whisper numbers in earnings forecasts often come from specialized financial analytics firms such as FactSet, Refinitiv, and Zacks Investment Research, which aggregate insights from company insiders, analysts, and market sentiment. Market participants also rely on platforms like Bloomberg Terminal and Thomson Reuters Eikon that provide real-time data and proprietary models to refine earnings expectations. Leveraging these sources helps investors make informed decisions by accessing discreet yet credible earnings estimates beyond official consensus figures.

Common Pitfalls When Using Whisper Numbers

Relying solely on whisper numbers in earnings forecasts can lead to misinformed marketing strategies due to their unofficial nature and lack of transparency. These anecdotal estimates often ignore broader market trends and analyst consensus, resulting in skewed expectations and potential overconfidence in campaign outcomes. Marketers risk misallocating budgets and mispricing products if they do not corroborate whisper numbers with verified financial data and comprehensive market analysis.

Whisper Numbers vs. Consensus Estimates: Key Differences

Whisper numbers represent the unofficial earnings expectations circulating among traders, often differing significantly from consensus estimates compiled by financial analysts. These figures can reveal market sentiment and potential surprises before official earnings announcements. Understanding the divergence between whisper numbers and consensus estimates helps marketers anticipate stock price volatility and craft timely investor communications.

Best Practices for Interpreting Whisper Numbers in Marketing

Whisper numbers in earnings provide marketers with real-time insights into market expectations, offering a competitive edge in campaign planning and budget allocation. Utilizing multiple data sources, including analyst forecasts and social media sentiment, enhances accuracy in interpreting these figures to anticipate market reactions effectively. Monitoring deviations between whisper numbers and reported earnings enables marketers to adjust messaging strategies promptly to capitalize on or mitigate market impacts.

example of whisper number in earnings Infographic

samplerz.com

samplerz.com