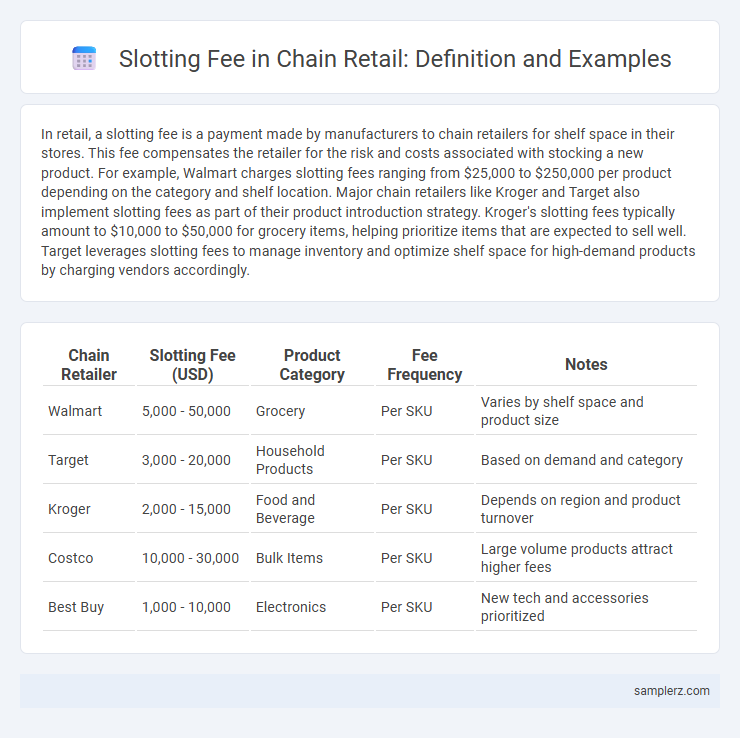

In retail, a slotting fee is a payment made by manufacturers to chain retailers for shelf space in their stores. This fee compensates the retailer for the risk and costs associated with stocking a new product. For example, Walmart charges slotting fees ranging from $25,000 to $250,000 per product depending on the category and shelf location. Major chain retailers like Kroger and Target also implement slotting fees as part of their product introduction strategy. Kroger's slotting fees typically amount to $10,000 to $50,000 for grocery items, helping prioritize items that are expected to sell well. Target leverages slotting fees to manage inventory and optimize shelf space for high-demand products by charging vendors accordingly.

Table of Comparison

| Chain Retailer | Slotting Fee (USD) | Product Category | Fee Frequency | Notes |

|---|---|---|---|---|

| Walmart | 5,000 - 50,000 | Grocery | Per SKU | Varies by shelf space and product size |

| Target | 3,000 - 20,000 | Household Products | Per SKU | Based on demand and category |

| Kroger | 2,000 - 15,000 | Food and Beverage | Per SKU | Depends on region and product turnover |

| Costco | 10,000 - 30,000 | Bulk Items | Per SKU | Large volume products attract higher fees |

| Best Buy | 1,000 - 10,000 | Electronics | Per SKU | New tech and accessories prioritized |

Understanding Slotting Fees in Chain Retailers

Slotting fees in chain retailers refer to the upfront charges manufacturers pay to secure shelf space for new products, significantly impacting product placement and visibility. These fees vary widely by retailer and product category, often ranging from $10,000 to over $100,000 per SKU, influencing both inventory decisions and profit margins. Understanding the financial and strategic role of slotting fees helps suppliers navigate retail partnerships and optimize product launch success.

Common Slotting Fee Practices Among Major Retail Chains

Major retail chains such as Walmart, Target, and Kroger commonly implement slotting fees ranging from $5,000 to $50,000 per product to secure shelf space for new items. These fees vary based on product category, store location, and expected sales volume, reflecting the retailer's negotiation leverage and inventory priorities. Slotting fees help large retailers manage risk and optimize their shelf assortment by filtering products with higher market potential.

Notable Slotting Fee Examples in Supermarkets

Notable slotting fee examples in supermarkets include Walmart, which charges suppliers fees ranging from $5,000 to $50,000 per item to secure shelf space, reflecting the high competition and premium placement value in its extensive network of over 4,700 stores. Kroger imposes slotting fees averaging $15,000 per new product introduction, leveraging its status as the largest supermarket chain in the U.S. to maximize supplier revenue through strategic shelf allocation. Target also utilizes slotting fees, often between $10,000 and $25,000, to manage product assortment within its more than 1,900 stores, balancing consumer demand with supplier investment.

Slotting Fee Structures in Grocery Retailers

Slotting fee structures in grocery retailers typically vary based on product category, shelf space, and store location, with fees ranging from $5,000 to over $50,000 per item. Large chain retailers such as Kroger and Safeway often implement tiered slotting fees, charging higher rates for prime shelf placement and new product introductions. These fees compensate retailers for inventory risk, shelf optimization, and marketing support, impacting manufacturer costs and product pricing strategies.

Case Study: Slotting Fees at Walmart and Target

Walmart and Target implement slotting fees to manage shelf space and reduce risks associated with new product introductions, typically charging manufacturers between $25,000 and $250,000 per SKU. These fees incentivize suppliers to optimize product offerings and cover costs related to inventory management, ensuring profitable retail operations. The strategic use of slotting fees at major chains like Walmart and Target highlights the financial and operational impact on both retailers and manufacturers in the competitive retail landscape.

How Specialty Retail Chains Implement Slotting Fees

Specialty retail chains implement slotting fees by charging suppliers fixed fees to secure shelf space in high-visibility areas, which offsets the retailer's inventory risk and merchandising costs. These fees vary based on product category, shelf position, and expected sales velocity, often ranging from $500 to $10,000 per SKU. Retailers like Williams-Sonoma and Sephora use slotting fees strategically to manage product assortment while maximizing revenue per square foot.

Impact of Slotting Fees on Product Placement in Chain Stores

Slotting fees imposed by chain retailers significantly influence product placement by prioritizing brands that can afford higher payments, often resulting in premium shelf space for established products. This financial barrier affects market competition, limiting exposure for smaller or new brands and impacting consumer choice. Retailers leverage these fees to manage inventory risk while optimizing shelf profitability, highlighting the critical role slotting fees play in shaping product visibility and sales outcomes in retail chains.

Real-Life Slotting Fee Negotiations with Retail Chains

Slotting fee negotiations between suppliers and chain retailers like Walmart often involve fees ranging from $25,000 to $250,000 per product to secure shelf space in high-traffic stores. During these negotiations, suppliers must demonstrate strong market demand projections and promotional support to justify the slotting fee, influencing retailer willingness. Real-life cases show that successful negotiations often include volume commitments and data-sharing agreements to optimize product placement and reduce retailer risk.

Brands Paying Premium Slotting Fees: Noteworthy Examples

Major chain retailers like Walmart and Target often charge slotting fees ranging from $10,000 to over $100,000 per product to secure prime shelf locations. Leading brands such as Procter & Gamble and Coca-Cola frequently pay these premium fees to enhance product visibility and market penetration. Such payments are strategic investments to gain competitive advantage in high-traffic retail environments.

Comparing Slotting Fees Across Leading Retail Chains

Leading retail chains like Walmart, Target, and Kroger impose varying slotting fees that can range from $1,000 to over $50,000 per SKU, reflecting their differing shelf space value and negotiation power. Walmart's slotting fees average around $25,000 for new product placements, whereas Target tends to charge between $10,000 and $30,000 depending on product category and region. Kroger typically imposes lower fees, averaging $5,000 to $15,000, emphasizing their emphasis on volume sales over premium shelf positioning.

example of slotting fee in chain retailer Infographic

samplerz.com

samplerz.com