Usufruct in real estate refers to the legal right granted to an individual to use and derive benefits from a property that belongs to another person. For example, a parent may retain usufruct rights on a family home, allowing them to live in and lease the property while the ownership has been transferred to their children. This arrangement ensures that the usufructuary enjoys income or use of the real estate without altering its substance or ownership. Data on usufruct in estate transactions reveal its common application in inheritance cases and family agreements. The usufructuary is responsible for maintaining the property but cannot sell or permanently alter it, preserving the asset for the owner. By structuring estate plans with usufruct rights, parties can optimize tax benefits and ensure long-term control over valuable real estate assets.

Table of Comparison

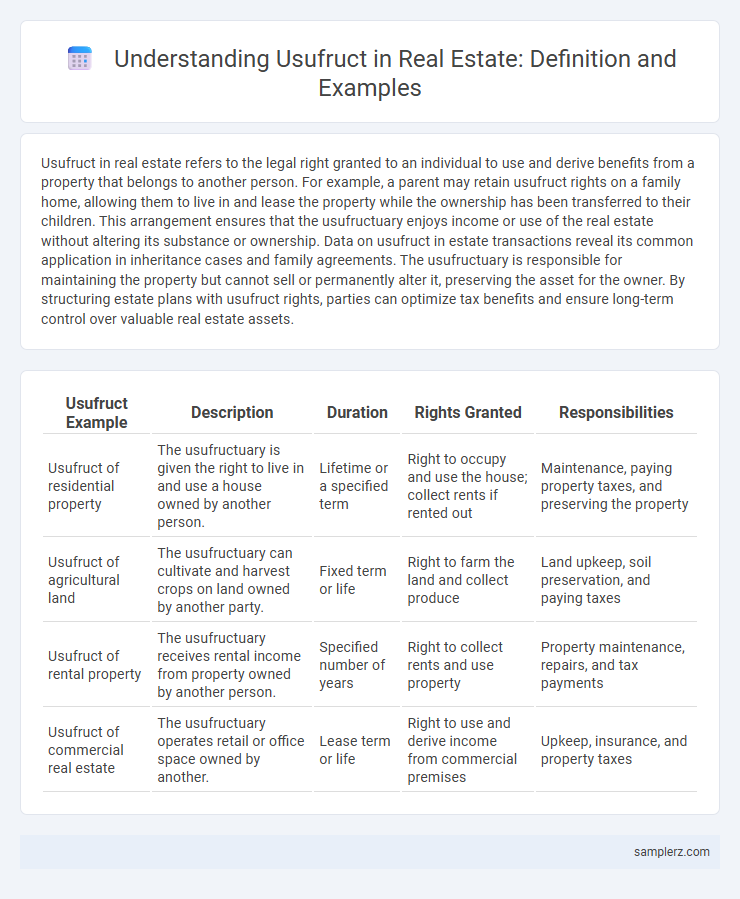

| Usufruct Example | Description | Duration | Rights Granted | Responsibilities |

|---|---|---|---|---|

| Usufruct of residential property | The usufructuary is given the right to live in and use a house owned by another person. | Lifetime or a specified term | Right to occupy and use the house; collect rents if rented out | Maintenance, paying property taxes, and preserving the property |

| Usufruct of agricultural land | The usufructuary can cultivate and harvest crops on land owned by another party. | Fixed term or life | Right to farm the land and collect produce | Land upkeep, soil preservation, and paying taxes |

| Usufruct of rental property | The usufructuary receives rental income from property owned by another person. | Specified number of years | Right to collect rents and use property | Property maintenance, repairs, and tax payments |

| Usufruct of commercial real estate | The usufructuary operates retail or office space owned by another. | Lease term or life | Right to use and derive income from commercial premises | Upkeep, insurance, and property taxes |

Understanding Usufruct in Real Estate

Usufruct in real estate grants a person the right to use and benefit from a property owned by another, typically allowing them to live in or rent out the property while preserving its value. This legal arrangement is common in estate planning to provide a surviving spouse with lifetime use of the family home without transferring full ownership. Understanding usufruct helps clarify rights and responsibilities, ensuring the property is maintained and returned in good condition to the owner or heirs after the usufruct period ends.

Key Legal Aspects of Usufruct Rights

Usufruct rights in real estate grant a person the legal authority to use and derive benefit from a property owned by another, without altering its substance. Key legal aspects include the temporary nature of these rights, which terminate upon expiration or the usufructuary's death, and obligations such as maintaining the property's value and refraining from causing damage. These rights are commonly established through contracts or statutory provisions, ensuring a clear distinction between ownership and usage.

Typical Usufruct Arrangements in Family Estates

In family estates, typical usufruct arrangements grant surviving spouses the right to use and benefit from property, such as rental income or agricultural produce, while the ownership (naked ownership) remains with the heirs. This legal structure ensures financial security for the usufructuary during their lifetime without transferring full ownership. Commonly seen in jurisdictions with civil law traditions, usufruct balances property management and inheritance planning efficiently.

Usufruct vs. Full Ownership: Main Differences

Usufruct in real estate allows a person to use and derive income from a property without owning it outright, contrasting with full ownership where the individual has complete rights to use, sell, or modify the property. The usufructuary must maintain the property's condition and cannot alter its substance, while the owner holds permanent rights including transferring or encumbering the estate. This distinction impacts estate planning, property management, and inheritance, influencing control, responsibility, and financial benefits tied to the real estate asset.

How Usufruct Impacts Property Inheritance

Usufruct grants a designated individual the right to use and derive income from an estate property while legally owned by another party, significantly affecting inheritance outcomes by limiting immediate full ownership transfer. During the usufruct period, heirs receive only naked ownership, delaying their rights to sell or modify the property. This arrangement protects the usufructuary's interests, such as lifetime residence or rental income, while preserving the property's underlying value for beneficiaries.

Practical Examples of Usufruct in Estate Planning

A common example of usufruct in estate planning is when a surviving spouse is granted the right to live in and use a family home during their lifetime while the ownership of the property remains with the children or other heirs. Another practical use is giving a family member usufruct rights over rental income from investment properties, enabling them to receive income without transferring full ownership. This arrangement helps preserve the estate's value and ensures the usufructuary benefits without permanently altering the property's title.

Duties and Restrictions of Usufructuaries

Usufructuaries in real estate must maintain the property in good condition, perform necessary repairs, and pay property taxes and insurance premiums to preserve its value. They are restricted from altering the property's substance or committing waste, ensuring the estate remains intact for the naked owner's future rights. Failure to comply with these duties can lead to legal liability and potential termination of the usufruct right.

Usufruct Rights: Benefits for Surviving Spouses

Usufruct rights grant surviving spouses the legal authority to use and benefit from real estate property without owning it outright, ensuring financial security and housing stability after a partner's death. This arrangement allows the spouse to collect rental income, make improvements, and reside in the property, while preserving the underlying ownership for heirs. By maintaining these rights, usufruct provides a balanced solution between inheritance equity and the surviving spouse's well-being in estate planning.

Usufruct Termination: When and How

Usufruct termination in real estate occurs upon the death of the usufructuary, expiration of a specified term, or fulfillment of a condition stipulated in the deed. Legal provisions also allow termination if the property is destroyed or if the usufructuary abuses their rights, leading to court intervention. Upon termination, full ownership reverts to the bare owner, who regains possession and control of the property free of usufruct claims.

Case Studies of Usufruct in Real Estate Transactions

Case studies of usufruct in real estate transactions often involve scenarios where one party retains the right to use and derive income from a property while the ownership remains with another. An example includes parents transferring ownership of a vacation home to their children while retaining usufruct rights for life, allowing them to live in or rent the property. Another case involves trusts where usufruct rights enable beneficiaries to occupy or lease estate properties, preserving the asset's value during the usufructuary period.

example of usufruct in estate Infographic

samplerz.com

samplerz.com