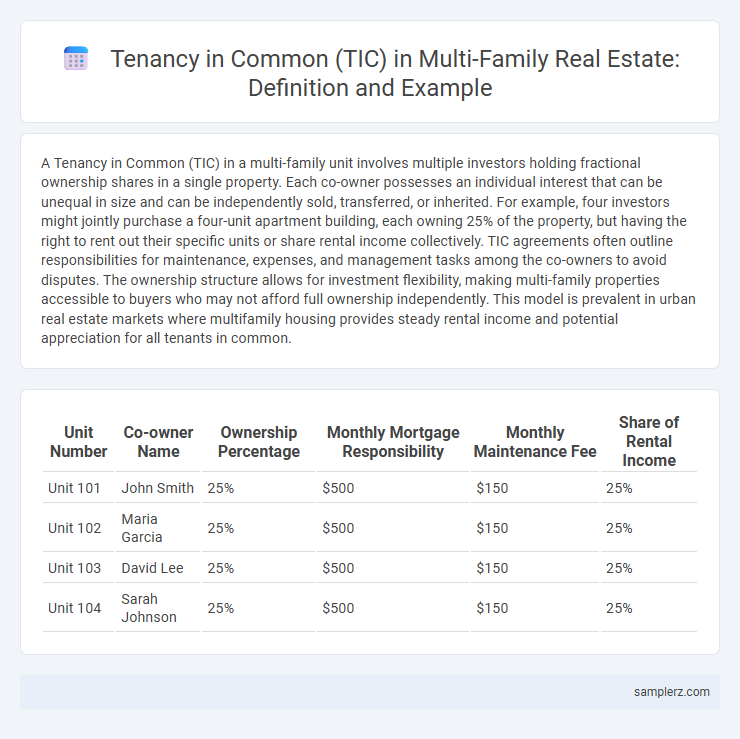

A Tenancy in Common (TIC) in a multi-family unit involves multiple investors holding fractional ownership shares in a single property. Each co-owner possesses an individual interest that can be unequal in size and can be independently sold, transferred, or inherited. For example, four investors might jointly purchase a four-unit apartment building, each owning 25% of the property, but having the right to rent out their specific units or share rental income collectively. TIC agreements often outline responsibilities for maintenance, expenses, and management tasks among the co-owners to avoid disputes. The ownership structure allows for investment flexibility, making multi-family properties accessible to buyers who may not afford full ownership independently. This model is prevalent in urban real estate markets where multifamily housing provides steady rental income and potential appreciation for all tenants in common.

Table of Comparison

| Unit Number | Co-owner Name | Ownership Percentage | Monthly Mortgage Responsibility | Monthly Maintenance Fee | Share of Rental Income |

|---|---|---|---|---|---|

| Unit 101 | John Smith | 25% | $500 | $150 | 25% |

| Unit 102 | Maria Garcia | 25% | $500 | $150 | 25% |

| Unit 103 | David Lee | 25% | $500 | $150 | 25% |

| Unit 104 | Sarah Johnson | 25% | $500 | $150 | 25% |

Introduction to Tenancy in Common (TIC) in Multi-Family Units

Tenancy in Common (TIC) in multi-family units allows multiple investors to own individual shares of a property, each holding a separate deed with distinct ownership percentages. This arrangement provides flexibility in financing and exit strategies, as co-owners can sell or transfer their interests independently without affecting the entire property. TIC structures are commonly used in real estate syndications and can help diversify investment risks across multiple stakeholders in apartment buildings or duplexes.

Key Features of TIC Arrangements for Multi-Family Properties

TIC (Tenancy in Common) arrangements in multi-family units allow multiple investors to own individual shares of the property, each holding an undivided interest without exclusive rights to a specific unit. Key features include shared responsibility for mortgage payments, property taxes, and maintenance costs, while owners can sell or transfer their interests independently. This structure provides flexibility in ownership percentages and simplifies joint management of multi-family real estate investments.

Real-World Example: TIC in a Fourplex Apartment Building

A Fourplex apartment building owned under a Tenancy in Common (TIC) agreement allows multiple investors to hold undivided fractional interests in each unit, enabling shared ownership while maintaining individual rights to transfer or sell their share independently. This arrangement facilitates collective investment in multi-family properties, reducing entry costs and distributing responsibilities such as maintenance and property taxes among co-owners. Real-world examples show TIC structures improving liquidity and diversification for investors in urban rental markets, enhancing portfolio flexibility within multi-unit residential assets.

How Co-Owners Share Financial Responsibilities in a TIC

In a Tenancy in Common (TIC) arrangement within a multi-family unit, co-owners share financial responsibilities based on their ownership percentages, which dictate their obligation to contribute toward mortgage payments, property taxes, insurance, and maintenance costs. Each owner is individually responsible for their share, ensuring equitable distribution of ongoing expenses despite separate financing agreements. This structure allows flexibility in financing but requires clear agreements to manage shared costs and avoid disputes among co-owners.

Legal Framework: Agreements and Rights in Multi-Family TICs

In multi-family TICs, legal frameworks revolve around detailed TIC agreements that define the rights and responsibilities of each co-owner, including the proportionate ownership shares and usage rights of individual units. These agreements typically outline rules for maintenance costs, property management, and dispute resolution to ensure smooth cohabitation and investment protection. Understanding these legal agreements is crucial for tenants to safeguard their interests and navigate shared ownership complexities within multi-family properties.

TIC Example: Investors Purchasing a Duplex Together

Investors purchasing a duplex under a tenancy in common (TIC) agreement each hold individual, undivided ownership interests while sharing rights to the entire property. This arrangement allows multiple parties to invest in multi-family units, sharing expenses, income, and responsibilities proportional to their ownership percentages. TIC ownership in a duplex enables flexibility in financing, taxation, and eventual sale of individual interests without dissolving the entire property ownership structure.

Structuring Ownership Shares in Multi-Family TICs

In multi-family tenancy in common (TIC) arrangements, ownership shares are structured based on the percentage of interest each co-owner holds in the property, allowing for flexible allocation of units or income. These shares are often defined in the TIC agreement, specifying rights, responsibilities, and financial obligations such as mortgage payments and maintenance costs. Properly structured ownership shares enable co-owners to maximize investment benefits while maintaining clear division of property rights and operational control.

Resolving Disputes in a Multi-Family TIC Scenario

In a multi-family TIC scenario, disputes often arise over shared expenses or property management decisions. Implementing a clear operating agreement with defined roles and a dispute resolution clause, such as mediation or arbitration, helps prevent conflicts from escalating. Regular communication and transparent financial reporting also contribute to smoother conflict resolution among co-owners.

Advantages and Drawbacks of TIC for Multi-Family Units

Tenancy in Common (TIC) in multi-family units allows multiple investors to share ownership while retaining individual interest rights, providing flexibility in financing and ease of transfer. Advantages include reduced upfront costs, shared maintenance responsibilities, and potential tax benefits through property depreciation. Drawbacks involve possible conflicts in decision-making, complex exit strategies, and limited control over the entire property's management.

Transitioning from TIC to Single Ownership: Success Stories

Several multi-family properties initially structured as Tenancy in Common (TIC) have successfully transitioned to single ownership through coordinated buyouts and refinancing strategies. In Los Angeles, one prominent example involved a 12-unit apartment complex where individual co-owners unified interests by leveraging joint capital to obtain a single mortgage, simplifying management and increasing property value. This transition demonstrates how consolidating TIC interests into a single ownership entity enhances marketability and streamlines decision-making in multi-family real estate investments.

example of TIC (tenancy in common) in multi-family unit Infographic

samplerz.com

samplerz.com