An example of an en-bloc sale in condominium redevelopment is the Amber Park collective sale in Singapore. The transaction involved the entire Amber Park estate, consisting of 366 residential units, sold to a developer for approximately SGD 1.68 billion. This sale enabled the developer to redevelop the site into a new high-rise residential project, maximizing land use and increasing property value. The en-bloc process requires approval from at least 80% of unit owners in the condominium, ensuring collective agreement. Following the sale, owners receive compensation based on the sale price and their share value in the property. En-bloc sales like Amber Park highlight trends in urban redevelopment and the transformation of aging condo estates into modern residential complexes.

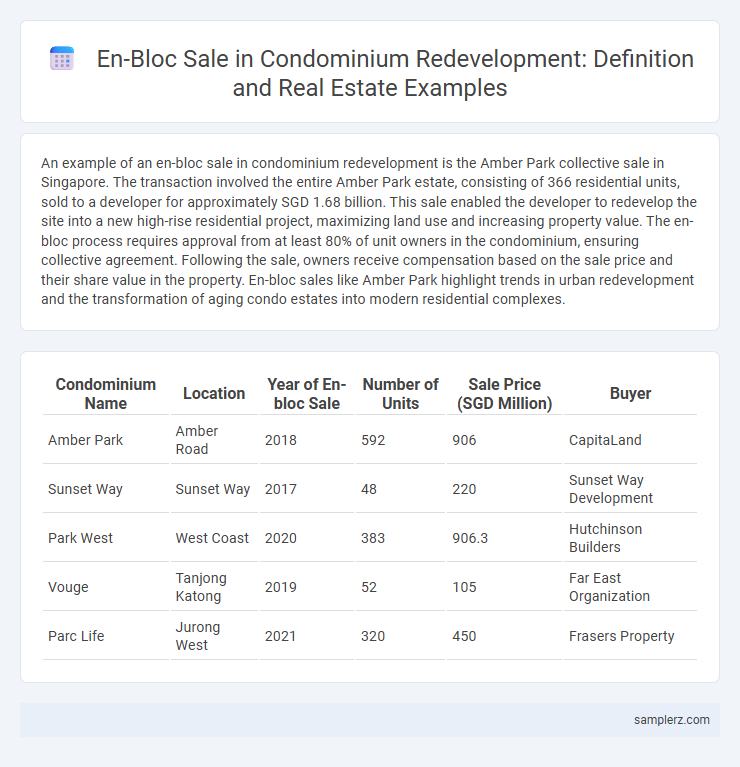

Table of Comparison

| Condominium Name | Location | Year of En-bloc Sale | Number of Units | Sale Price (SGD Million) | Buyer |

|---|---|---|---|---|---|

| Amber Park | Amber Road | 2018 | 592 | 906 | CapitaLand |

| Sunset Way | Sunset Way | 2017 | 48 | 220 | Sunset Way Development |

| Park West | West Coast | 2020 | 383 | 906.3 | Hutchinson Builders |

| Vouge | Tanjong Katong | 2019 | 52 | 105 | Far East Organization |

| Parc Life | Jurong West | 2021 | 320 | 450 | Frasers Property |

Understanding En-Bloc Sales in Condominium Redevelopment

En-bloc sales in condominium redevelopment involve collective agreements where all unit owners agree to sell their property to a developer for large-scale reclamation or reconstruction. A prominent example is the Tiong Bahru Plaza redevelopment in Singapore, where the entire condominium was sold en-bloc to enable redevelopment into a modern residential and commercial complex. Understanding the legal framework, valuation processes, and collective sales thresholds is crucial for homeowners to maximize their returns during en-bloc redevelopment projects.

Key Factors Driving En-Bloc Sales in Real Estate

Key factors driving en-bloc sales in condominium redevelopment include favorable government regulations such as the Land Titles (Strata) Act, high market demand for new residential projects, and attractive financial incentives offered to owners. Aging buildings with low maintenance appeal and limited renovation potential increase collective interest in redevelopment opportunities. Strong developer interest fueled by prime locations and potential for higher returns significantly accelerates en-bloc sales momentum.

Notable Historical En-Bloc Sale Examples in Singapore

The notable historical en-bloc sale of The Edge in 1997 marked Singapore's first successful condominium redevelopment, setting a precedent for future collective sales. Another significant example is the 2007 Golden Mile Complex en-bloc sale, which involved one of the largest transgenerational buyouts and highlighted the complexities of mixed-use properties. These landmark cases demonstrate the evolving landscape of Singapore's real estate market and the strategic value of en-bloc sales in urban renewal.

The En-Bloc Sale Process: Step-by-Step Overview

The en-bloc sale process in condominium redevelopment begins with the formation of a collective sales committee representing the majority of unit owners, typically requiring at least 80% consensus to initiate the sale. Following the mandate, the committee appoints a marketing agent to conduct property valuation and engage potential buyers, leading to negotiation of the sale price. Upon agreement, owners vote to finalize the sale, after which the property is transferred to the developer for redevelopment, with proceeds distributed based on pre-agreed terms in the collective sales agreement.

Success Stories: Landmark Condominium En-Bloc Redevelopments

The Dakota Crest condominium garnered significant attention with its en-bloc sale valued at over SGD 900 million, setting a record for successful condominium redevelopment in Singapore. Another landmark example is the Farrer Court en-bloc deal, which achieved one of the highest per-unit gains for its owners, demonstrating strong market demand for condominium redevelopment projects. These success stories highlight how strategic en-bloc sales drive urban renewal and unlock substantial value for property owners.

Financial Implications of En-Bloc Sales for Owners

En-bloc sales in condominium redevelopment often result in substantial financial gains for owners through lump-sum payouts derived from collective property sale at market-valued prices. Owners may face short-term financial adjustments due to relocation costs and tax implications, including potential capital gains tax liabilities depending on jurisdiction. The redistribution of proceeds can significantly enhance owners' net worth, enabling reinvestment opportunities in newer properties or diversified assets.

Major Developers Behind Successful En-Bloc Deals

Major developers like CapitaLand, CDL, and UOL Group have spearheaded successful en-bloc sales in condominium redevelopment, leveraging their extensive market expertise and financial strength. These developers strategically acquire aging properties, unlock value through redevelopment, and maximize returns for owners and investors. Their track record in orchestrating complex en-bloc transactions underscores their pivotal role in shaping Singapore's property landscape.

Government Policies Influencing En-Bloc Sales

Singapore's Land Titles (Strata) Act governs en-bloc sales, requiring at least 80% owner agreement to initiate redevelopment. The government's introduction of the Residential Property Act impacts foreign ownership rules during en-bloc transactions, promoting local stakeholder control. Planning guidelines by the Urban Redevelopment Authority influence permissible development intensity, shaping redevelopment potential and property valuations in en-bloc sales.

Challenges Faced During En-Bloc Redevelopment Projects

En-bloc sale in condominium redevelopment often encounters legal challenges, including disputes over consent thresholds among minority owners and complex strata title regulations. Financial complications arise from fluctuating market conditions, impacting project viability and delaying approval processes. Coordination difficulties between stakeholders, such as developers, residents, and authorities, further complicate timeline adherence and project execution.

Future Trends in Condominium En-Bloc Sales

Emerging trends in condominium en-bloc sales highlight increasing interest from institutional investors and developers seeking large-scale redevelopment opportunities in prime urban locations. Advances in urban planning and zoning reforms are facilitating more flexible redevelopment options, boosting the appeal of en-bloc acquisitions as a strategic approach to maximize land value. Technology integration, such as AI-driven market analysis and digital platforms for collective decision-making among owners, is streamlining the en-bloc sale process and enhancing negotiation efficiency.

example of en-bloc sale in condominium redevelopment Infographic

samplerz.com

samplerz.com