Dark money in political fundraising refers to funds donated to nonprofit organizations that can influence elections without disclosing their donors' identities. These groups, often classified under 501(c)(4) or 501(c)(6) tax-exempt statuses, spend millions anonymously to support candidates or political causes. The lack of transparency obscures the true sources of campaign financing, raising concerns about undue influence and accountability in the democratic process. One notable example occurred during the 2012 U.S. presidential election, where dark money groups spent over $300 million on ads and other activities supporting specific candidates. Organizations like Crossroads GPS and American Crossroads funneled significant amounts without revealing their backers. This phenomenon highlights the growing role of undisclosed contributions in shaping electoral outcomes and policy debates.

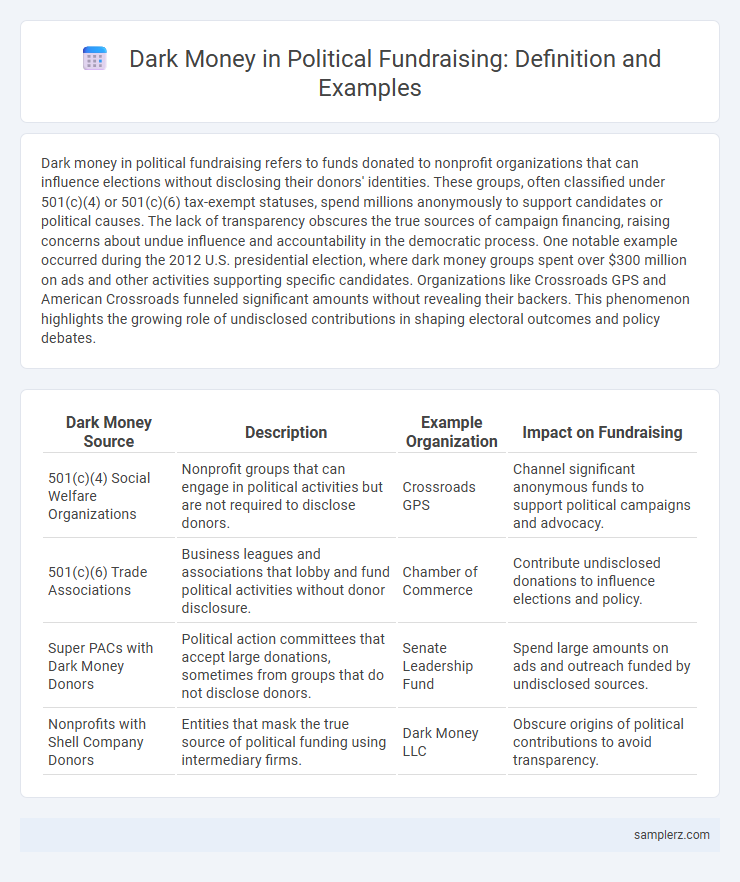

Table of Comparison

| Dark Money Source | Description | Example Organization | Impact on Fundraising |

|---|---|---|---|

| 501(c)(4) Social Welfare Organizations | Nonprofit groups that can engage in political activities but are not required to disclose donors. | Crossroads GPS | Channel significant anonymous funds to support political campaigns and advocacy. |

| 501(c)(6) Trade Associations | Business leagues and associations that lobby and fund political activities without donor disclosure. | Chamber of Commerce | Contribute undisclosed donations to influence elections and policy. |

| Super PACs with Dark Money Donors | Political action committees that accept large donations, sometimes from groups that do not disclose donors. | Senate Leadership Fund | Spend large amounts on ads and outreach funded by undisclosed sources. |

| Nonprofits with Shell Company Donors | Entities that mask the true source of political funding using intermediary firms. | Dark Money LLC | Obscure origins of political contributions to avoid transparency. |

Unveiling Dark Money: Definition and Political Impact

Dark money refers to political spending by nonprofit organizations that are not required to disclose their donors, allowing anonymous funding in election campaigns. This hidden funding can significantly influence election outcomes and policy decisions by enabling wealthy entities to exert disproportionate political power without public accountability. Cases like the 2010 Citizens United ruling exemplify how dark money has surged, reshaping campaign finance and challenging transparency in democratic processes.

Famous Cases of Dark Money in U.S. Election Campaigns

The 2012 U.S. presidential election highlighted extensive use of dark money, with groups like American Crossroads and Crossroads GPS funneling over $100 million without disclosing donors. In 2010, Citizens United v. FEC opened floodgates for super PACs, enabling undisclosed corporate and individual contributions to heavily influence campaigns. Another notable case is the 2014 midterm elections, where a reported $300 million in dark money donations shaped key Senate races through secretive funding channels.

How Shell Organizations Funnel Undisclosed Funds

Shell organizations in political fundraising often serve as intermediaries that obscure the source of dark money, channeling undisclosed funds to campaigns or advocacy groups without revealing donor identities. These entities create complex layers of financial transactions, making it challenging for regulators and watchdogs to trace the original source of contributions. This practice significantly impacts transparency in elections by allowing unlimited, unreported expenditures that influence political outcomes without public accountability.

The Role of Super PACs in Concealing Donors

Super PACs play a critical role in funneling dark money into political campaigns by allowing unlimited contributions without disclosing donor identities, effectively concealing the sources of funding. These entities use complex layers of nonprofit organizations and shell companies to obscure the original contributors, making it difficult for regulators and the public to trace the flow of money. The Supreme Court's Citizens United decision further empowered Super PACs, intensifying concerns about transparency and the influence of undisclosed wealthy donors in politics.

International Examples of Dark Money Influencing Elections

Dark money in international elections often involves undisclosed corporate donations from offshore entities impacting political campaigns, as seen in the 2018 Brazilian elections where opaque funding sources influenced candidate advertising. In the 2019 European Parliament elections, reports revealed hidden financial support from foreign interests aimed at swaying nationalist parties across multiple member states. These examples demonstrate how untraceable funds complicate transparency and undermine democratic processes on a global scale.

Nonprofit Groups and the Loophole in Political Financing

Nonprofit groups classified under 501(c)(4) status exploit a significant loophole in political financing by funneling dark money into election campaigns without disclosing donor identities. These organizations engage in extensive political advocacy and fundraising, benefiting from minimal regulatory oversight that obscures the original source of funds. The lack of transparency in this nonprofit dark money channel undermines campaign finance laws and challenges efforts to ensure accountable political contributions.

High-Profile Scandals: Dark Money in Presidential Races

Dark money has notably influenced presidential races, with the 2012 U.S. election revealing over $300 million spent by undisclosed donors to super PACs supporting both major candidates. The 2020 election saw a surge in dark money, exceeding $1 billion, funneled through nonprofit groups like Priorities USA Action and the Senate Leadership Fund, complicating transparency and accountability. These high-profile scandals highlight the pervasive impact of opaque financial contributions on U.S. electoral integrity and democratic processes.

The Supreme Court’s Citizens United Decision and Its Aftermath

The Supreme Court's Citizens United decision in 2010 radically transformed political fundraising by enabling unlimited corporate and union spending through independent expenditures, significantly increasing the flow of dark money in elections. Nonprofit organizations classified under Section 501(c)(4) of the tax code emerged as key vehicles for channeling undisclosed contributions, obscuring donor identities and inflating the influence of wealthy special interests. This ruling has led to a surge in politically active outside groups, reshaping campaign finance dynamics and intensifying concerns over transparency and accountability in the democratic process.

Dark Money in State and Local Government Campaigns

Dark money in state and local government campaigns often flows through nonprofit organizations that do not disclose their donors, enabling unlimited contributions that influence election outcomes. These undisclosed funds are used to fund advertising, voter mobilization, and other campaign efforts, bypassing traditional transparency requirements. States with weaker disclosure laws see higher dark money involvement, complicating efforts to monitor campaign finance and ensure accountability.

Strategies to Expose and Regulate Dark Money in Politics

Dark money in political fundraising often involves undisclosed donations by nonprofit organizations, loopholes allowing anonymous contributions, and super PACs exploiting limited transparency. Strategies to expose and regulate dark money include implementing stringent disclosure laws requiring donor transparency, enhancing the powers of the Federal Election Commission (FEC) to audit and investigate suspicious funding sources, and promoting public funding options to reduce candidate reliance on opaque donations. Comprehensive campaign finance reforms and real-time digital reporting platforms also serve to increase accountability and deter illicit financial influence in elections.

example of dark money in fundraising Infographic

samplerz.com

samplerz.com