A line-item veto in government appropriations allows an executive authority to reject specific provisions or expenditures within a budget bill without vetoing the entire legislation. For example, a governor might use a line-item veto to eliminate funding allocated for a particular infrastructure project while approving the rest of the state budget. This power helps control spending by targeting individual budget items deemed unnecessary or excessive. The line-item veto is intended to promote fiscal responsibility and prevent wasteful expenditures in government appropriations. Data shows that states with this authority often experience more deliberate budget control, focusing on reducing unnecessary costs. However, its use can be controversial, as it may shift legislative power to the executive branch, impacting the balance of government entities.

Table of Comparison

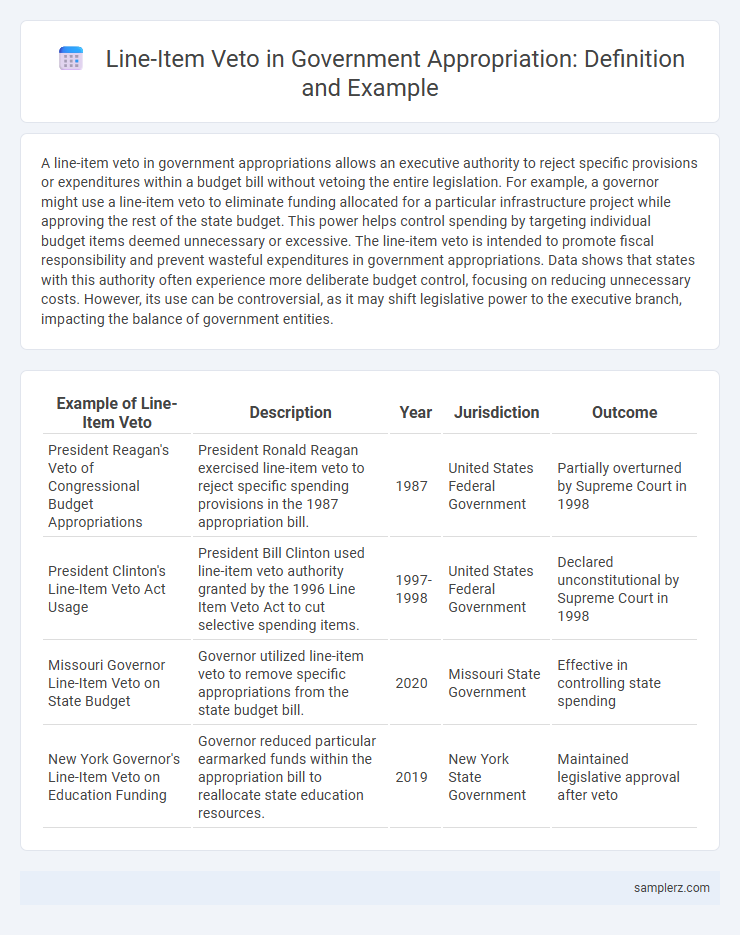

| Example of Line-Item Veto | Description | Year | Jurisdiction | Outcome |

|---|---|---|---|---|

| President Reagan's Veto of Congressional Budget Appropriations | President Ronald Reagan exercised line-item veto to reject specific spending provisions in the 1987 appropriation bill. | 1987 | United States Federal Government | Partially overturned by Supreme Court in 1998 |

| President Clinton's Line-Item Veto Act Usage | President Bill Clinton used line-item veto authority granted by the 1996 Line Item Veto Act to cut selective spending items. | 1997-1998 | United States Federal Government | Declared unconstitutional by Supreme Court in 1998 |

| Missouri Governor Line-Item Veto on State Budget | Governor utilized line-item veto to remove specific appropriations from the state budget bill. | 2020 | Missouri State Government | Effective in controlling state spending |

| New York Governor's Line-Item Veto on Education Funding | Governor reduced particular earmarked funds within the appropriation bill to reallocate state education resources. | 2019 | New York State Government | Maintained legislative approval after veto |

Understanding Line-Item Veto in Government Appropriations

The line-item veto allows government executives to selectively reject specific provisions or items within appropriation bills without vetoing the entire legislation, enhancing budgetary control and curbing excessive spending. This power is used to eliminate wasteful expenditures, ensuring funds are allocated efficiently to priority programs. Understanding the application of the line-item veto highlights its role in promoting fiscal responsibility and preventing unnecessary government spending.

Historical Instances of Line-Item Veto Usage

Historical instances of line-item veto usage include President Grover Cleveland's 1886 veto of specific items in the Sundry Civil Appropriations Bill and President Bill Clinton's extensive use of the line-item veto in 1996 following its enactment under the Line Item Veto Act. These examples highlight how executive authority was applied to remove particular budget expenditures without rejecting entire bills. The Supreme Court ultimately ruled the Line Item Veto Act unconstitutional in 1998, limiting future presidents' use of the tool.

Notable Federal Examples of Line-Item Veto in Appropriation Bills

Notable federal examples of line-item veto in appropriation bills include the Line Item Veto Act of 1996, which granted the President authority to reject specific budget items without vetoing entire bills, although it was later ruled unconstitutional by the Supreme Court in Clinton v. City of New York (1998). Prior to this act, select appropriations contained provisions allowing for partial vetoes at the state level, influencing debates over federal budget control mechanisms. These cases underscore the ongoing tension between executive budgetary control and legislative appropriation powers in U.S. government finance.

Line-Item Veto in State Governments: Case Studies

Line-item veto in state governments allows governors to reject specific budget items without vetoing an entire appropriation bill, enhancing fiscal control. For example, Texas and New York have utilized line-item vetoes to eliminate non-essential expenditures, thereby promoting budget efficiency and accountability. Studies show this tool helps prevent overspending and aligns state budgets with policy priorities effectively.

Legal Challenges to Line-Item Veto Authority

Legal challenges to line-item veto authority in appropriations often center on constitutional separation of powers, as seen in the Supreme Court case Clinton v. City of New York (1998) which ruled the line-item veto unconstitutional. Critics argue that allowing executives to unilaterally amend or repeal parts of legislation disrupts the legislative balance and bypasses congressional authority. Ongoing debates emphasize the need for clear statutory guidelines and judicial oversight to prevent executive overreach in budgetary decisions.

Impacts of Line-Item Veto on Budgetary Allocations

The line-item veto allows executives to reject specific budgetary provisions without vetoing entire appropriation bills, enabling more precise fiscal control and targeted reductions of unnecessary expenditures. This selective veto power can lead to more efficient allocation of government resources by eliminating pork-barrel spending and reducing budget deficits. However, it may also shift the balance of power between the legislative and executive branches, impacting the overall transparency and negotiation processes in budgetary allocations.

Policy Implications of Line-Item Veto in Appropriation Processes

The line-item veto allows government executives to reject specific budget items without vetoing entire appropriations bills, enabling more precise fiscal control and potential reduction of unnecessary expenditures. This power can alter the balance between legislative intent and executive influence, often leading to debates over the constitutionality and scope of executive authority. Policy implications include enhanced budgetary discipline, but risks of undermining legislative priorities and increasing political conflict in the appropriation process.

Line-Item Veto as a Tool for Fiscal Responsibility

The line-item veto empowers governors and presidents to selectively eliminate specific expenditure items within appropriation bills, ensuring targeted budget control and reducing unnecessary spending. By exercising this fiscal tool, officials can prevent pork-barrel projects and redirect resources toward priority programs, enhancing budget efficiency. This mechanism promotes accountability and transparency in government spending, reinforcing disciplined fiscal management.

Comparing Line-Item Veto Powers Across States

Line-item veto powers vary significantly among states, with approximately 44 governors possessing some form of this authority to reject specific appropriation items without vetoing entire budgets. States like Texas and Wisconsin grant robust line-item veto powers, allowing governors to remove individual expenditures to control spending, whereas states such as California restrict this power primarily to appropriation bills only. Comparative analysis reveals that stronger line-item veto authority correlates with enhanced fiscal control and reduced budgetary waste, influencing state-level financial governance and efficiency.

Future Prospects for Line-Item Veto in Government Appropriation

Future prospects for the line-item veto in government appropriation include advancements in legislative technology that enable more precise budget adjustments and increased oversight to prevent fiscal excess. Emerging digital tools could empower executives to selectively veto specific spending items while preserving overall budget integrity. Legal reforms and judicial rulings may also shape the expansion or limitation of line-item veto powers in the next decade.

example of line-item veto in appropriation Infographic

samplerz.com

samplerz.com