A quadplex in real estate refers to a multi-family residential building designed to house four separate units under one roof. Each unit typically includes distinct living spaces such as kitchens, bedrooms, and bathrooms, making it ideal for investors seeking rental income from multiple tenants. Quadplex properties are commonly found in urban and suburban areas where demand for affordable housing is high. Investors favor quadplexes for their potential to generate steady cash flow and diversify income streams within a single property. Data shows that quadplexes often provide a higher return on investment compared to single-family homes due to the combined rent from four units. These properties also offer advantages in financing and tax benefits, making them a popular choice in the real estate market.

Table of Comparison

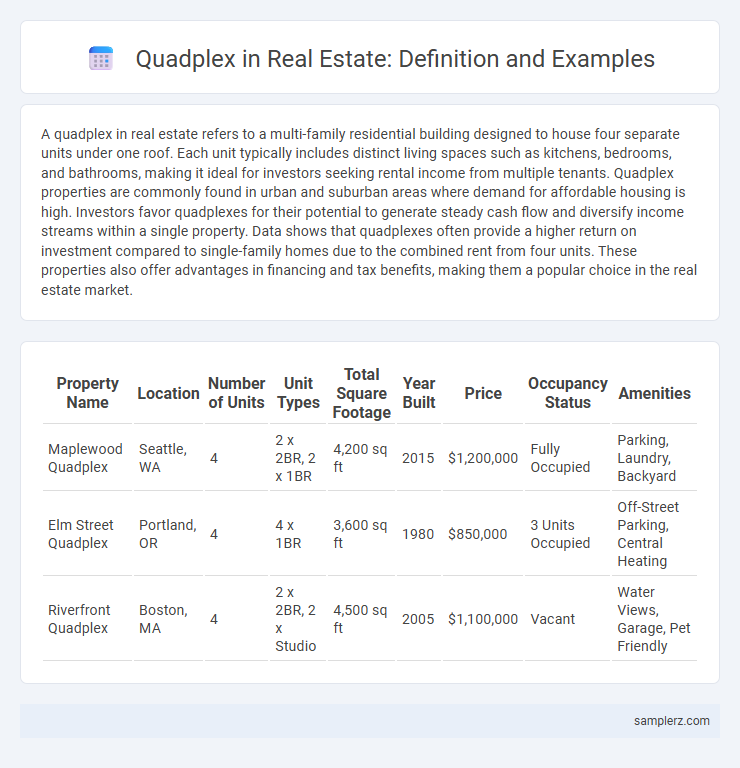

| Property Name | Location | Number of Units | Unit Types | Total Square Footage | Year Built | Price | Occupancy Status | Amenities |

|---|---|---|---|---|---|---|---|---|

| Maplewood Quadplex | Seattle, WA | 4 | 2 x 2BR, 2 x 1BR | 4,200 sq ft | 2015 | $1,200,000 | Fully Occupied | Parking, Laundry, Backyard |

| Elm Street Quadplex | Portland, OR | 4 | 4 x 1BR | 3,600 sq ft | 1980 | $850,000 | 3 Units Occupied | Off-Street Parking, Central Heating |

| Riverfront Quadplex | Boston, MA | 4 | 2 x 2BR, 2 x Studio | 4,500 sq ft | 2005 | $1,100,000 | Vacant | Water Views, Garage, Pet Friendly |

What is a Quadplex in Real Estate?

A quadplex in real estate is a residential building composed of four separate housing units, each with its own entrance and amenities, designed for multiple tenants or families. Investors often choose quadplexes to generate rental income through diversified cash flow streams from four distinct leases. This multi-family property type offers a balance between single-family homes and larger apartment complexes, providing manageable maintenance and higher occupancy potential.

Key Features of a Quadplex Property

A quadplex property consists of four separate units within one building, offering multiple rental income streams for investors. Key features include individual entrances for each unit, separate utility meters to manage expenses independently, and ample parking space to accommodate residents. This type of multifamily property typically attracts diverse tenant profiles, enhancing occupancy stability and investment returns.

Advantages of Investing in Quadplexes

Investing in quadplexes offers a unique advantage of diversified income streams from four separate units within a single property, reducing risk compared to single-family homes. These multi-unit properties attract varied tenant profiles, enhancing occupancy rates and cash flow stability. Quadplex investments often qualify for residential financing, providing lower interest rates and easier loan terms than larger apartment complexes, improving overall return on investment.

Typical Floor Plans for Quadplex Buildings

Typical floor plans for quadplex buildings often feature four separate units arranged in a symmetrical layout, maximizing land use and rental potential. Each unit usually includes two to three bedrooms, one or two bathrooms, a living area, and a compact kitchen, designed for efficient space utilization. Common configurations include side-by-side units sharing a central wall or stacked units with two on the ground floor and two above, optimizing both privacy and accessibility.

Financing Options for Quadplex Purchases

Financing options for quadplex purchases often include conventional multifamily loans, FHA multifamily loans, and portfolio loans tailored for small-scale investors. Conventional loans typically require a minimum down payment of 20-25% with competitive interest rates, while FHA loans offer lower down payments around 3.5% but have specific owner-occupancy requirements. Investors should also consider local and state housing programs that provide grants or subsidies designed to encourage multifamily property investments.

Zoning Laws and Quadplex Approval

Zoning laws play a crucial role in determining the feasibility of constructing a quadplex, as they regulate land use and dictate whether multi-family residential buildings are permitted in specific areas. Municipalities often require detailed approval processes for quadplex developments, including compliance with density limits, setback requirements, and occupancy regulations. Understanding local zoning codes and securing the necessary permits ensures legal quadplex approval and maximizes investment potential in real estate projects.

Example Quadplex Listings in Major Cities

Quadplex listings in major cities such as New York, Los Angeles, and Chicago offer diverse investment opportunities with multiple rental units under one property. These properties typically feature four separate entrances and utilities, maximizing rental income and appealing to investors seeking multi-family housing options. Popular neighborhoods like Brooklyn, Echo Park, and Lincoln Park provide prime locations for quadplex investments with strong rental demand and potential for appreciation.

Rental Income Potential with Quadplexes

A quadplex in real estate offers significant rental income potential by providing four separate units within one property, allowing investors to diversify rental income streams and reduce vacancy risks. Each unit can generate consistent monthly cash flow, maximizing overall returns compared to single-family homes, especially in high-demand rental markets. Investors benefit from economies of scale in maintenance and management costs while leveraging property appreciation across multiple units.

Maintenance Tips for Quadplex Owners

Regular inspections of HVAC systems, plumbing, and roofing help prevent costly repairs in quadplex properties. Efficient waste disposal and timely landscaping maintain curb appeal and tenant satisfaction. Investing in preventive maintenance, such as sealing cracks and servicing appliances, prolongs property value and reduces vacancy rates.

Comparing Quadplexes to Duplexes and Triplexes

Quadplexes offer four separate living units within one building, providing higher rental income potential compared to duplexes and triplexes, which have two and three units respectively. They typically attract investors seeking to maximize cash flow while minimizing management complexity by consolidating multiple units under one roof. Compared to duplexes and triplexes, quadplexes often present better economies of scale in maintenance and property management costs.

example of quadplex in real estate Infographic

samplerz.com

samplerz.com