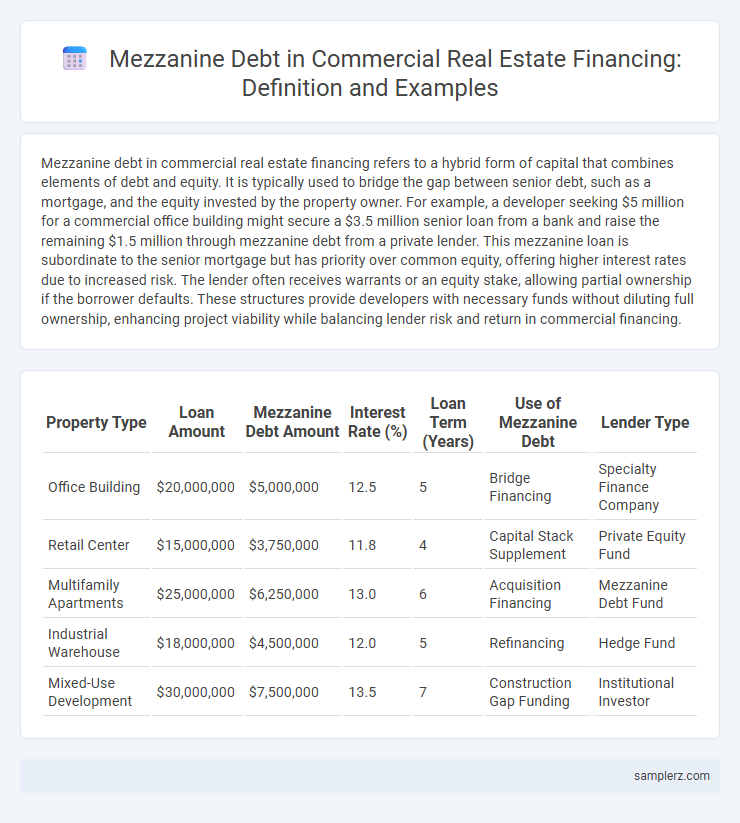

Mezzanine debt in commercial real estate financing refers to a hybrid form of capital that combines elements of debt and equity. It is typically used to bridge the gap between senior debt, such as a mortgage, and the equity invested by the property owner. For example, a developer seeking $5 million for a commercial office building might secure a $3.5 million senior loan from a bank and raise the remaining $1.5 million through mezzanine debt from a private lender. This mezzanine loan is subordinate to the senior mortgage but has priority over common equity, offering higher interest rates due to increased risk. The lender often receives warrants or an equity stake, allowing partial ownership if the borrower defaults. These structures provide developers with necessary funds without diluting full ownership, enhancing project viability while balancing lender risk and return in commercial financing.

Table of Comparison

| Property Type | Loan Amount | Mezzanine Debt Amount | Interest Rate (%) | Loan Term (Years) | Use of Mezzanine Debt | Lender Type |

|---|---|---|---|---|---|---|

| Office Building | $20,000,000 | $5,000,000 | 12.5 | 5 | Bridge Financing | Specialty Finance Company |

| Retail Center | $15,000,000 | $3,750,000 | 11.8 | 4 | Capital Stack Supplement | Private Equity Fund |

| Multifamily Apartments | $25,000,000 | $6,250,000 | 13.0 | 6 | Acquisition Financing | Mezzanine Debt Fund |

| Industrial Warehouse | $18,000,000 | $4,500,000 | 12.0 | 5 | Refinancing | Hedge Fund |

| Mixed-Use Development | $30,000,000 | $7,500,000 | 13.5 | 7 | Construction Gap Funding | Institutional Investor |

Understanding Mezzanine Debt in Commercial Real Estate

Mezzanine debt in commercial real estate serves as a hybrid financing tool, positioned between senior debt and equity, typically offering interest rates ranging from 12% to 20%. This type of financing enables developers to bridge equity gaps in large-scale projects, such as office towers or retail centers, providing up to 30% of the overall capital stack. Understanding mezzanine debt helps investors leverage higher returns while accepting increased risk compared to traditional loans.

Key Features of Mezzanine Financing

Mezzanine financing in commercial real estate typically involves subordinated debt secured by equity interests, offering lenders higher returns through interest rates ranging from 12% to 20%. Key features include flexible repayment terms, interest-only payments during the loan term, and the option for lenders to convert debt into equity in case of borrower default. This financing bridges the gap between senior debt and equity, enabling developers to secure additional capital without diluting ownership.

How Mezzanine Debt Bridges Funding Gaps

Mezzanine debt serves as a crucial financial tool in commercial real estate financing by bridging the gap between senior loans and equity, typically covering 10-30% of project costs. Often structured as subordinated debt with embedded equity warrants, mezzanine financing allows developers to access additional capital without diluting ownership. This form of capital enhances leverage capacity and facilitates project completion when traditional lending falls short.

Example: Mezzanine Debt in Office Building Acquisition

Mezzanine debt in office building acquisition often fills the financing gap between senior loans and equity, typically ranging from 10% to 20% of the total capital stack. For example, a $50 million office property might secure $35 million in senior debt, $10 million in mezzanine financing, and $5 million in equity, enhancing leverage without diluting ownership. This subordinated debt carries higher interest rates, usually between 8% and 15%, reflecting its increased risk compared to senior loans.

Applying Mezzanine Financing to Hotel Developments

Mezzanine debt in commercial real estate financing for hotel developments often bridges the gap between senior loans and equity, allowing developers to secure additional capital without sacrificing ownership stakes. This hybrid financing tool typically carries higher interest rates than senior debt but offers flexible repayment terms tailored to the cash flow variability of hotel operations. Major hotel projects leverage mezzanine financing to fund expansions, renovations, or new builds while preserving budget elasticities and maintaining lender relationships.

Case Study: Mixed-Use Property and Mezzanine Loans

A mixed-use property in downtown Chicago secured $10 million through mezzanine loans to bridge the gap between its senior debt and equity. The mezzanine debt, typically carrying higher interest rates around 12-15%, provided flexible financing without diluting ownership, enabling property renovations and tenant acquisition. This layered capital structure optimized leverage while maintaining project control, highlighting mezzanine loans' role in complex commercial real estate transactions.

Mezzanine Debt Structure in Retail Center Expansion

Mezzanine debt in retail center expansion typically involves subordinated financing positioned between senior debt and equity, providing capital for developers seeking flexible growth funding. This structure often includes a combination of fixed interest payments and equity kickers, allowing lenders to share in the project's upside potential. Retail center expansions benefit from mezzanine debt by accessing additional capital without diluting ownership, supporting lease-up periods and tenant improvement costs.

Example of Mezzanine Debt in Industrial Projects

Mezzanine debt in industrial project financing often involves subordinated loans that bridge the gap between senior debt and equity, typically ranging from 10% to 20% of the total capital stack. For example, a $50 million warehouse development might secure $35 million in senior loans and $7 million in mezzanine debt, providing additional leverage without diluting ownership. This structure enhances returns for sponsors while mitigating lender risk through higher interest rates and equity warrants embedded in the mezzanine financing.

Risk and Return Profile for Mezzanine Lenders

Mezzanine debt in commercial real estate financing typically carries higher risk due to its subordinate position behind senior loans, exposing lenders to greater potential loss in default scenarios. This increased risk is compensated by elevated interest rates and equity participation, resulting in attractive returns that often exceed those of traditional senior debt. Mezzanine lenders must carefully assess the borrower's cash flow stability and project viability to balance the higher yield against the inherent credit risk.

Comparing Mezzanine Debt to Other Commercial Financing Options

Mezzanine debt in commercial real estate financing offers higher leverage compared to traditional bank loans, typically ranging from 10% to 30% of the total capital stack, filling the gap between senior debt and equity. Unlike preferred equity, mezzanine debt provides lenders with a fixed interest rate plus potential equity participation without diluting ownership control. Compared to bridge loans, mezzanine debt carries higher interest rates but offers longer terms and greater flexibility in repayment structures, making it suitable for developers seeking growth capital with less immediate pressure.

example of mezzanine debt in commercial financing Infographic

samplerz.com

samplerz.com