A hypothec in mortgage is a legal charge on real estate property used as security for a loan. It grants the lender the right to seize and sell the property if the borrower defaults on the mortgage payments. This mechanism helps lenders mitigate risks by ensuring repayment through collateralized real estate assets. In practice, a hypothec involves registering the charge in public land records, establishing a priority lien against the property. Mortgage hypothecs are common in jurisdictions following civil law systems, such as Quebec in Canada. Borrowers benefit by obtaining financing while retaining ownership, subject to repayment obligations secured by their real estate.

Table of Comparison

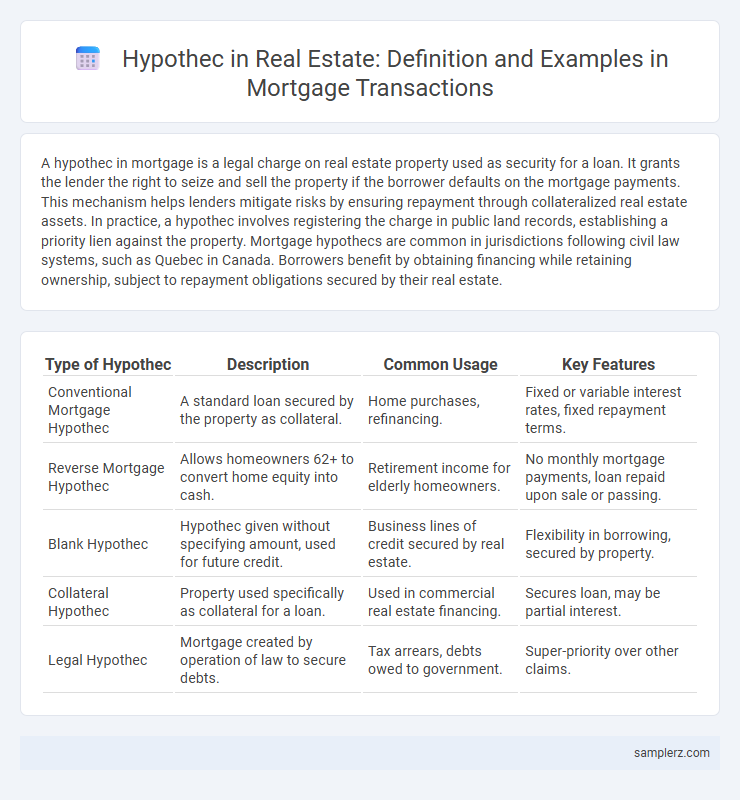

| Type of Hypothec | Description | Common Usage | Key Features |

|---|---|---|---|

| Conventional Mortgage Hypothec | A standard loan secured by the property as collateral. | Home purchases, refinancing. | Fixed or variable interest rates, fixed repayment terms. |

| Reverse Mortgage Hypothec | Allows homeowners 62+ to convert home equity into cash. | Retirement income for elderly homeowners. | No monthly mortgage payments, loan repaid upon sale or passing. |

| Blank Hypothec | Hypothec given without specifying amount, used for future credit. | Business lines of credit secured by real estate. | Flexibility in borrowing, secured by property. |

| Collateral Hypothec | Property used specifically as collateral for a loan. | Used in commercial real estate financing. | Secures loan, may be partial interest. |

| Legal Hypothec | Mortgage created by operation of law to secure debts. | Tax arrears, debts owed to government. | Super-priority over other claims. |

Understanding Hypothec: A Key Concept in Mortgages

A hypothec in mortgages represents a legal charge on a property, allowing lenders to secure a loan without transferring ownership. This legal mechanism ensures the lender's right to claim the property if the borrower defaults on payments, reinforcing the security of the mortgage agreement. Understanding the concept of hypothec is crucial for both lenders and borrowers to navigate property financing and risk management effectively.

What Sets Hypothec Apart from Traditional Mortgages

A hypothec differs from traditional mortgages by securing a loan without transferring property ownership, allowing borrowers to retain possession of the asset while using it as collateral. This legal mechanism, common in jurisdictions such as Quebec and Louisiana, provides lenders with a claim on the property if the borrower defaults. Unlike traditional mortgages, hypothecs do not require the physical handover of the deed, offering a flexible financing option in real estate transactions.

Real-Life Examples of Hypothec in Residential Mortgages

In residential mortgages, a common example of hypothec occurs when a homeowner pledges their property as security for a loan, allowing the lender to claim the house if payments default. For instance, if a borrower takes a mortgage of $300,000 on a family home valued at $400,000, the hypothec ensures the lender's right to foreclose and sell the property to recover the outstanding debt. This legal mechanism protects both the borrower's ownership rights until default and the lender's financial interest in the mortgage agreement.

How Hypothec Works in Commercial Real Estate Financing

In commercial real estate financing, a hypothec serves as a legal charge against the property, allowing the lender to secure a loan while the borrower retains possession and use of the asset. The hypothec creates a priority claim on the property's value, enabling the lender to recover the outstanding debt through foreclosure if the borrower defaults. This mechanism facilitates substantial capital acquisition for commercial developers and investors while mitigating lender risk.

Legal Aspects of Hypothec in the Mortgage Process

A hypothec in the mortgage process is a legal charge granting the lender a security interest in the debtor's property without transferring ownership, ensuring claim priority in case of default. It requires precise documentation, including a notarized mortgage deed, and must be registered with the relevant land registry to be enforceable. Legal regulations vary by jurisdiction but commonly mandate disclosure, borrower consent, and adherence to foreclosure procedures for protecting both parties' rights.

Advantages of Using Hypothec for Property Buyers

Hypothec in mortgage secures property loans without transferring title, allowing buyers to retain ownership while obtaining financing. This provides low-interest rates and flexible repayment terms compared to unsecured loans, reducing overall borrowing costs. Property owners benefit from enhanced credit opportunities and protection against foreclosure through regulated lien priority.

Hypothec vs. Pledge: Key Differences in Real Estate

A hypothec in real estate mortgage is a security interest granting the lender rights over the property without transferring possession, unlike a pledge which involves handing over possession of an asset as collateral. Hypothecs allow borrowers to retain control and use of the property while securing loan repayment, making them common in real estate financing. The key difference lies in possession and control, where hypothecs preserve possession with the debtor, whereas pledges require transferring possession to the creditor.

Step-by-Step Example: Hypothec in Action for Home Purchases

A hypothec in mortgage begins when a borrower and lender agree on a home loan secured by the property as collateral. For example, a buyer purchases a $300,000 home with a $240,000 hypothec mortgage, where the lender holds a legal claim on the house until the loan is fully repaid. If the borrower defaults, the lender can initiate foreclosure to recover the outstanding balance, ensuring protection of the mortgage investment.

Risks and Protections for Lenders in Hypothec Mortgages

Hypothec mortgages allow lenders to secure loans with real estate without transferring property ownership, reducing the risk of borrower default through a legally enforceable lien. Lenders gain protections via priority rights, enabling them to claim repayment from sale proceeds before other creditors if the borrower defaults. However, risks include property devaluation and potential disputes over lien priority, which can be mitigated through thorough appraisal and proper registration of the hypothec.

Global Perspectives: Hypothec Usage in Different Countries

In Canada, the hypothec concept is applied primarily through mortgages where the borrower pledges property as security without transferring ownership, allowing for flexible creditor rights. In France, the hypothec acts as a lien on real estate, enabling lenders to claim repayment through property sale if borrowers default, similar to mortgage liens but without possession transfer. Scandinavian countries utilize the hypothec system extensively for mortgage financing, emphasizing borrower protection and creditor priority within their regulated property and credit frameworks.

example of hypothec in mortgage Infographic

samplerz.com

samplerz.com