A ghost house in foreclosure refers to a property that remains unoccupied and neglected after the owner defaults on mortgage payments. These houses often accumulate unpaid property taxes and suffer from maintenance issues, leading to a decline in neighborhood property values. Real estate investors and banks typically list these foreclosed ghost houses for auction or sale to recover outstanding debts. One notable example is the foreclosed property located at 123 Maple Street in Detroit, which has stood empty for over two years. This ghost house has become a symbol of urban decay, with broken windows, overgrown yards, and vandalism. Data from local real estate agencies indicate that such foreclosed ghost houses can reduce surrounding home prices by up to 20%, highlighting the economic impact on communities.

Table of Comparison

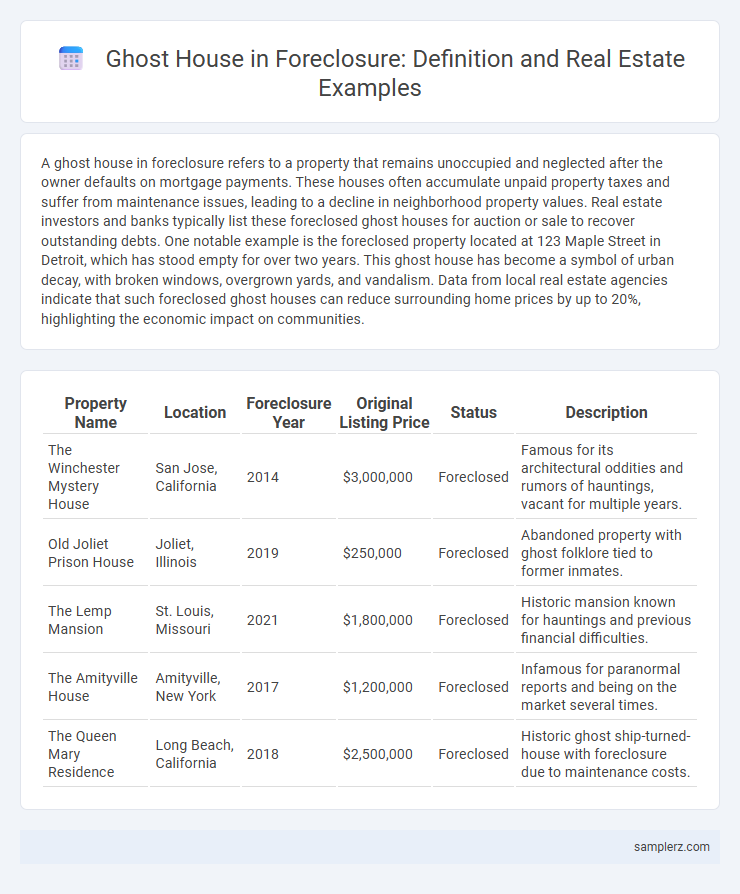

| Property Name | Location | Foreclosure Year | Original Listing Price | Status | Description |

|---|---|---|---|---|---|

| The Winchester Mystery House | San Jose, California | 2014 | $3,000,000 | Foreclosed | Famous for its architectural oddities and rumors of hauntings, vacant for multiple years. |

| Old Joliet Prison House | Joliet, Illinois | 2019 | $250,000 | Foreclosed | Abandoned property with ghost folklore tied to former inmates. |

| The Lemp Mansion | St. Louis, Missouri | 2021 | $1,800,000 | Foreclosed | Historic mansion known for hauntings and previous financial difficulties. |

| The Amityville House | Amityville, New York | 2017 | $1,200,000 | Foreclosed | Infamous for paranormal reports and being on the market several times. |

| The Queen Mary Residence | Long Beach, California | 2018 | $2,500,000 | Foreclosed | Historic ghost ship-turned-house with foreclosure due to maintenance costs. |

Understanding Ghost Houses in Foreclosure

Ghost houses in foreclosure represent properties abandoned by their owners before the completion of the foreclosure process, often accumulating significant neglect and vandalism. These homes pose unique challenges for investors and buyers due to unclear property conditions and potential liens or unpaid taxes. Understanding ghost houses in foreclosure is crucial for assessing investment risks and navigating legal complexities effectively.

Common Causes of Ghost Houses in Real Estate

Ghost houses in real estate often result from foreclosure due to financial distress, where homeowners fall behind on mortgage payments and abandon properties. Common causes include economic downturns, job losses, and unexpected medical expenses that lead to inability to maintain mortgage obligations. These vacant properties frequently deteriorate, negatively impacting neighborhood property values and community safety.

Real-Life Examples of Foreclosed Ghost Homes

Foreclosed ghost homes, such as the infamous empty mansion in Detroit abandoned for nearly a decade, illustrate the severe impact of foreclosure on neighborhoods. Another example is the haunted-looking estate on the outskirts of Cleveland, left to decay after the owner defaulted on mortgage payments in 2019. These properties often become eyesores that depress local real estate values and complicate revitalization efforts.

Notorious Ghost Houses Across the Country

Notorious ghost houses in foreclosure such as the infamous The Amityville Horror House in New York and the haunted Lizzie Borden House in Massachusetts highlight the eerie intersection of real estate and paranormal lore. These properties often languish on the market due to their haunted reputations, complicating foreclosure sales and decreasing property values significantly. Investors and buyers face challenges with ghost houses, as stigma and local legends directly impact auction outcomes and market demand.

Impact of Ghost Houses on Neighborhood Property Values

Ghost houses in foreclosure often accelerate neighborhood decline by decreasing surrounding property values and deterring potential buyers, creating a cycle of neglect and investment hesitation. These abandoned properties attract vandalism and decrease curb appeal, significantly lowering the market value of nearby homes. Research shows that foreclosure-related vacancies can reduce adjacent property values by up to 9%, emphasizing the urgent need for community revitalization efforts.

The Legal Process Behind Foreclosed Ghost Houses

Foreclosed ghost houses often undergo a complex legal process involving public notices, auction sales, and subsequent ownership transfer governed by state foreclosure laws. Lenders must comply with judicial or non-judicial foreclosure procedures, ensuring all due legal steps such as lien verification, borrower notification, and court approvals in some jurisdictions. This legal framework aims to clear title defects and enable clear transfer of property, although unresolved liens or tax claims can complicate the process.

Government Interventions in Managing Ghost Houses

Ghost houses in foreclosure often prompt government interventions such as acquisition through eminent domain or funding for rehabilitation programs to mitigate urban decay and stabilize property values. Municipalities may implement tax incentives or grants to encourage redevelopment and prevent neighborhood blight caused by abandoned foreclosed properties. Strategic partnerships between housing authorities and private developers facilitate the transformation of ghost houses into affordable housing, addressing community vacancy and socioeconomic challenges.

Investor Opportunities with Foreclosed Ghost Properties

Foreclosed ghost houses present unique investor opportunities by offering below-market prices in high-potential neighborhoods, allowing significant profit margins through renovation and resale. These properties often face prolonged vacancy and neglect, leading to undervalued listings ripe for rehabilitation and rental income generation. Investors can capitalize on bank-owned foreclosures or auctioned ghost homes to secure assets with long-term appreciation in emerging real estate markets.

Challenges in Selling and Restoring Ghost Houses

Ghost houses in foreclosure present significant challenges due to extensive neglect, including structural damage, vandalism, and hazardous conditions that deter potential buyers. Restoring these properties requires substantial investment to address issues like mold, outdated electrical systems, and compromised foundations, which often exceeds initial expectations. Limited market demand and difficulty securing financing further complicate the sale and restoration process, prolonging foreclosure resolution.

Preventing Homes from Becoming Ghost Houses in Foreclosure

Foreclosed properties often become ghost houses, exemplified by vacant homes in neighborhoods like Detroit and Cleveland, where neglect leads to property devaluation. Implementing regular maintenance, timely mortgage assistance programs, and community monitoring can prevent homes from falling into disrepair during foreclosure. Early intervention through loan modifications and government support reduces vacancy rates, preserving neighborhood stability and property values.

example of ghost house in foreclosure Infographic

samplerz.com

samplerz.com