An example of an encumbrance in a real estate title is a mortgage lien. This lien represents a legal claim by a lender on the property until the loan is fully repaid. The mortgage encumbrance affects the owner's ability to transfer clear title without satisfying the debt. Another common encumbrance is a restrictive covenant, which limits the use of the property according to specified terms. These restrictions might include limitations on building types, property use, or alterations. Such covenants are recorded in the title and bind future owners to comply with the outlined conditions.

Table of Comparison

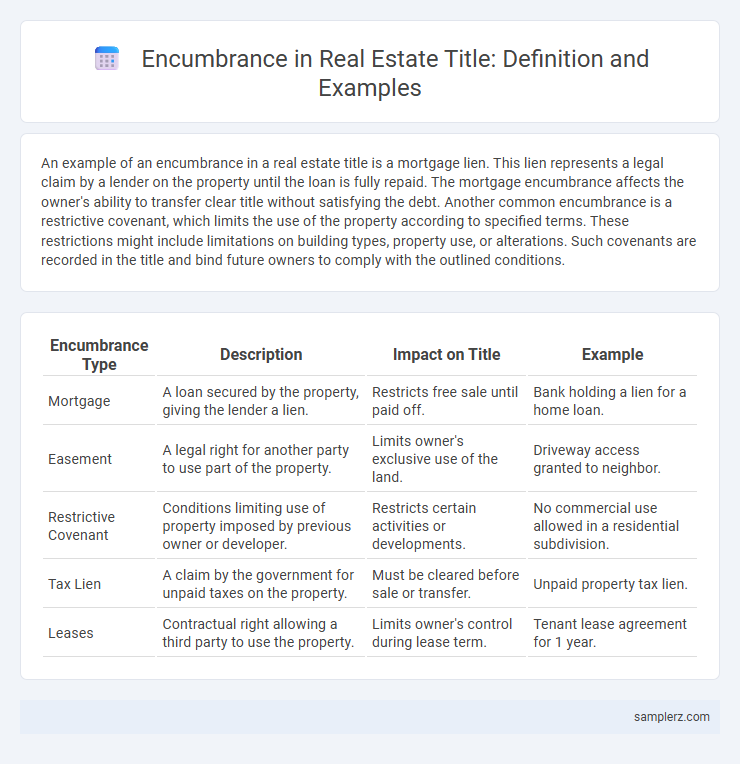

| Encumbrance Type | Description | Impact on Title | Example |

|---|---|---|---|

| Mortgage | A loan secured by the property, giving the lender a lien. | Restricts free sale until paid off. | Bank holding a lien for a home loan. |

| Easement | A legal right for another party to use part of the property. | Limits owner's exclusive use of the land. | Driveway access granted to neighbor. |

| Restrictive Covenant | Conditions limiting use of property imposed by previous owner or developer. | Restricts certain activities or developments. | No commercial use allowed in a residential subdivision. |

| Tax Lien | A claim by the government for unpaid taxes on the property. | Must be cleared before sale or transfer. | Unpaid property tax lien. |

| Leases | Contractual right allowing a third party to use the property. | Limits owner's control during lease term. | Tenant lease agreement for 1 year. |

Common Types of Encumbrances in Real Estate Titles

Common types of encumbrances in real estate titles include liens, easements, and restrictive covenants, which affect the property's use or transferability. Liens such as mortgage or tax liens represent a claim against the property for debt repayment. Easements grant third parties rights to access or use portions of the property, while restrictive covenants impose limitations on property use, often set by homeowners' associations or developers.

Understanding Easements as Title Encumbrances

Easements represent a common type of encumbrance affecting real estate titles, granting specific usage rights to a party other than the property owner, such as access or utility maintenance. These legal rights do not transfer ownership but restrict the owner's ability to freely use or develop the property. Understanding easements is essential for buyers and sellers to assess property value and potential limitations on use or future improvements.

Liens: Financial Claims on Property Titles

Liens represent significant financial claims on property titles, restricting the owner's ability to transfer clear ownership until the debt is settled. Common examples include mortgage liens, tax liens, and mechanic's liens, each prioritizing the creditor's right to seek repayment through property sale proceeds. Understanding liens is crucial in real estate transactions to avoid unexpected liabilities and ensure a clear title transfer.

Restrictive Covenants: Limitations on Property Use

Restrictive covenants are legal obligations written into property deeds that limit the use or development of the land, often imposed by a developer or homeowners association to maintain neighborhood standards. These encumbrances can restrict activities like building structures above a certain height, running a business from the property, or altering the exterior appearance. Understanding restrictive covenants is crucial for buyers, as they directly impact property value and future use rights.

Encroachments: Unauthorized Use of Land

Encroachments represent a common type of encumbrance in real estate titles, occurring when a structure or improvement unlawfully extends onto an adjacent property. These unauthorized uses can lead to legal disputes, reducing the marketability and value of the affected land. Title reports often identify encroachments, which require resolution through boundary agreements or removal to clear the property's title.

Leases as Encumbrances on Property Titles

Leases represent a common form of encumbrance on property titles, granting tenants legal rights to occupy and use the property for a specified period while limiting the owner's full control. This encumbrance affects the property's marketability and value, as potential buyers must honor existing lease agreements or negotiate their terms. Understanding lease encumbrances is crucial for real estate investors to assess title risks and ensure clear property rights before purchase.

Mortgages: A Primary Example of Title Encumbrance

Mortgages represent a primary example of title encumbrance in real estate, as they create a legal claim or lien against the property until the loan is fully repaid. This encumbrance impacts the owner's ability to transfer clear title, requiring mortgage satisfaction or lender approval during property sales. Understanding mortgage liens is essential for buyers to ensure unencumbered ownership and clear property title.

Zoning Restrictions Impacting Property Titles

Zoning restrictions are a common example of encumbrances that affect property titles by limiting land use and development potential. These legal constraints can reduce the market value of real estate by restricting building height, density, or type of permissible activities. Understanding zoning laws is crucial for buyers and investors to assess the true worth and possible uses of a property before purchase.

Deed Restrictions and Title Encumbrance

Deed restrictions are a common type of encumbrance that limit how a property can be used or modified, often set by a previous owner or a homeowners association to preserve neighborhood standards. Title encumbrance includes any claim, lien, or liability attached to the property title, such as mortgage liens, easements, or deed restrictions, which can affect the owner's ability to transfer full ownership rights. Understanding these encumbrances is crucial for buyers and investors to assess property value and ensure clear title transfer during real estate transactions.

How Encumbrances Affect Property Transactions

Encumbrances such as liens, easements, and restrictive covenants can significantly impact property transactions by limiting the owner's rights or decreasing the property's market value. Lenders often require a clear title free of encumbrances before approving a mortgage, making title searches and title insurance critical components of the transaction process. Buyers must thoroughly investigate any existing encumbrances to avoid unexpected legal liabilities or restrictions after purchase.

example of encumbrance in title Infographic

samplerz.com

samplerz.com